Jason Harvestdancer

Contributor

I got these links from CNN, since people around here think CNN is unbiased.

Have Americans forgotten the ghosts of inflation past? By Charles Riley, CNN Business

Who are you going to believe, Krugman or your lying eyes?

Beware the Fed's asset price 'monsters' By Charles Riley, CNN Business

Ah, but it is only the investors talking, only people who actually work in the economy. Pay no attention to them and listen to government economists instead.

The Fed needs to get real about inflation Analysis by Paul R. La Monica, CNN Business

Okay, so they can't deny it outright, so they're calling it "transitory".

Inflation worries spook US stocks By CNN Business

So worrying about inflation is the cause of inflation.

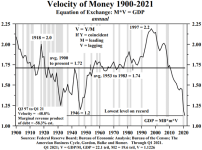

I don't know how bad it will get, I think we're in for something like the 1970s. Some are actually predicting hyperinflation, but as long as the dollar is the world's reserve currency that is unlikely. Either way, I think we're in for a bumpy ride.

Have Americans forgotten the ghosts of inflation past? By Charles Riley, CNN Business

Inflation is not something we're used to worrying about.

In fact, the only Americans with real memories of runaway inflation and its effect on household finances are likely to be those over the age of 60.

Remember (or don't): US inflation peaked at 14.7% in March and April 1980, with the economy experiencing "stagflation," a nightmare scenario characterized by weak growth and rising prices.

The Federal Reserve finally got inflation under control when former Chair Paul Volcker constricted the money supply and sent interest rates higher. Rates on conventional 30-year mortgages peaked at 18.45%, but prices moderated and people dependent on fixed incomes breathed a sigh a relief.

...

Right, so. Back to the big question: Is inflation here to stay? The truth is that nobody really knows.

"Either the US inflation uptick is temporary, or the Fed is dangerously complacent. Either way, we're going to see tolerance of higher inflation tested further in the months ahead," said Societe Generale analyst Kit Juckes.

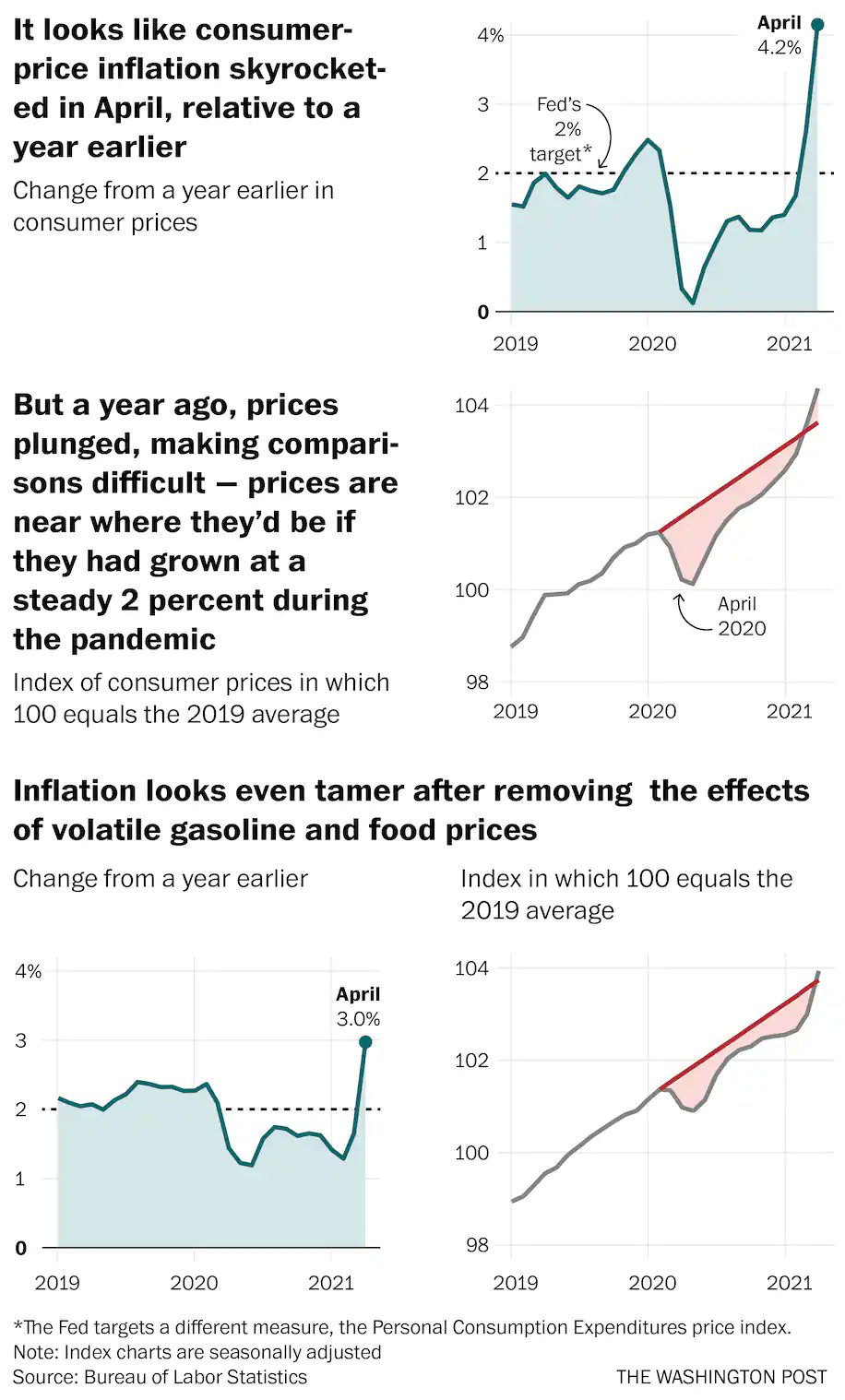

Paul Krugman, the Nobel Prize-winning economist who writes a column for the New York Times, argues that US inflation figures are being bloated by temporary factors including supply bottlenecks caused by the pandemic.

He wrote last week that policymakers should "keep their cool."

"This doesn't look at all like 1970s stagflation redux; it looks like a temporary blip, reflecting transitory disruptions as the economy struggles to recover from pandemic disruptions," he wrote.

Who are you going to believe, Krugman or your lying eyes?

Beware the Fed's asset price 'monsters' By Charles Riley, CNN Business

Remember: Ultra low interest rates and massive bond purchases by the Fed have helped accelerate the recovery from the pandemic. But they have also spurred a huge stock market rally, plus spikes in real estate prices and other assets.

Now, investors are worried that accelerating inflation will force the central bank to pull back stimulus sooner than anticipated. Fed officials have largely waved off these fears, saying they expect price hikes to be fleeting.

Ah, but it is only the investors talking, only people who actually work in the economy. Pay no attention to them and listen to government economists instead.

The Fed needs to get real about inflation Analysis by Paul R. La Monica, CNN Business

Federal Reserve chairman Jerome Powell loves to use the word "transitory" to describe the threat of inflation. But with each passing day, it looks more and more like inflation pressures are mounting in a much more significant manner than the Fed would like.

The use of the word "transitory" could very well turn out to be transitory. Powell may need a new catchphrase to describe how inflation might be a bit stickier and thornier problem.

Wages are rising and so are bond yields. The housing market is still chugging along. The prices of many retail goods are going up, partly because of supply shortages but also because of real demand.

It is true that the US economy (especially the job market) still hasn't fully recovered from the depths of the coronavirus recession. But the Fed may be underestimating the recent rebound and the potential for sky-high inflation like in the late 1970s and early 1980s.

"The Fed is putting out the message that inflation is transitory and that there are still 8 million unemployed. The problem is that price expectations in various markets from wood to labor and company pricing strategies are running ahead of economic reality," said Sebastien Galy, senior macro strategist at Nordea Asset Management, in a report Wednesday.

Okay, so they can't deny it outright, so they're calling it "transitory".

Inflation worries spook US stocks By CNN Business

US stocks finished lower on Wednesday even after paring some of their earlier losses.

Worries over rapidly increasing inflation were spurred on by inflation reports from Canada and out of Europe, dragging shares down.

Meanwhile, the Federal Reserve’s meeting minutes suggested that while a temporary increase in inflation is part of its plan, the central bank might need to begin discussing what’s next if the economy continues to make strong progress.

So worrying about inflation is the cause of inflation.

I don't know how bad it will get, I think we're in for something like the 1970s. Some are actually predicting hyperinflation, but as long as the dollar is the world's reserve currency that is unlikely. Either way, I think we're in for a bumpy ride.