There aren't enough billionaires in the US to really make that much of a difference. US billionaires have a cumulative wealth of $4.6T. Even in the very unlikely case that we were to implement the Cherokee Princess' 6% wealth tax, that would bring in less than $280G.

What do you mean? Billionaires are not taxed lower than most people. They do not have access to EITC, child tax credit and other tool that allow 47% of Americans to not pay any federal income taxes at all or even pay effective negative federal taxes.

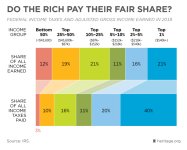

This is an interesting graph, although it lumps all 1%ers together and does not single out the super-wealthy.

View attachment 34586

What the Left wants is special taxes for the super-wealthy, either by redefining income or taxing wealth.

And I get that there’s a lot of government waste out their.

Yes, their[sic] is. And the Congress wants to add about $3.5T of it now.

Just run for Congress and try to cut defense spending. See what happens.

Squad private

Cori Bush ran on defunding the Pentagon.