- Joined

- Oct 22, 2002

- Messages

- 38,799

- Location

- Frozen in Michigan

- Gender

- Old Fart

- Basic Beliefs

- Don't be a dick.

C/P'd from a twitter user.:

Thoughts?

Something I've learned while in law school is about the social construction of crime. I work in a legal clinic on wage theft cases, where employers have "improperly paid" workers by not paying, paying below min wage, withholding overtime, paid sick time, etc. 1/

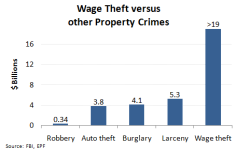

Most theft is wage theft. Meaning, the dollar value of stolen wages is greater than the value, each year, of all burglaries+robberies, shoplifting, auto theft, combined. Yet, wage theft is NOT A CRIME 2/

If you steal $100 from your employer, you will get arrested. If you call the police because your paycheck is $100 light, the police will tell you to file a complaint with the AG, and the AG will settle the case for between $50 and $200. 3/

(That's actually not true, bc AG's only take on big cases with thousands of dollars are stake, but they will settle big cases by typically requiring the employer to properly pay what is owed. No jail, no criminal record). 4/

If the AG doesn't want to take the case, it will give you a Private Right of Action to sue the employer in civil court for what you are owed, plus damages. It can take a 6 to 18 months to win at trial, and months or years to collect on the judgment if you win. 5/

In short, we address the predominant form of theft in the US with civil court cases, not criminal cases. We have literally defined "wage theft" as not a crime. Theft by you, a crime. Theft by your employer, not a crime.

This is what we mean when we say crime is "socially constructed." Not all social harms are criminalized. Not all actors committing social harm are criminalized.

I settled a case for $27K for three clients last year. We spent a MONTH negotiating the non-disclosure agreement because the employer stated if all his employees sued him and settled like this, he would go BANKRUPT. His business model DEPENDED on wage theft. 8/

These employers go on to hold elected office. 45 famously used wage theft to improve his finances on construction projects, leaving a trail of victims in his wake. Some sued and he had to pay them. Others didn't have resources to pursue multi-year litigation + got nothing. 9/

What should we do about it? criminalize employers or decriminalize theft or something else? 10/

Wage theft shows that we believe restitution is important. Giving the money back is important. Currently, AG keeps track of bad actors and will increase future financial penalties for bad actors. 11/

It also shows when harm is committed, we don't have to lock someone in a cage or label them a felon, both of which destroy years of life even after the sentence is over. We can demand restitution instead of punishment. 11/

It also shows how ridiculous the label "high crime neighborhood" is. And the arbitrary and racist response of police surveillance in HCN. Because we defined it that way.

Consider the social construction of murder: 12/

Poison a person, go to jail, they call you a felon for life. Poison a city resulting in dozens of deaths and thousands with brain damage, get a teaching fellowship at Harvard, they call you ex-Gov of Michigan Rick Snyder. Same with much corporate poisoning. 13/

The people commiting the most harm aren't in jail, don't live in high crime neighborhoods. And "black people commit more crime" is true only bc of how we have defined crimes, and how we then surveil their community in response to find more crimes. 14/"

Thoughts?