arkirk

Veteran Member

It's the same thing. When you give "it" more power you give "them" more power.

This is the starting premise. "they" control "it".

That doesn't follow. If the banks control the financial regulators, giving the financial regulators more power will not necessarily give the banks more power. The empowered financial regulators could pass laws that lessen the power of banks, for example.

On the other hand, giving the financial regulators LESS power will ALWAYS give the banks MORE power.

And it should go without saying, but giving the banks LESS power will, by definition, lessen the power of banks.

Since giving more power to financial regulators could go either way, and giving them less power will just make things worse, the only rational course of action is to shift our focus away from the financial regulators and onto the banks themselves.

Is anyone here cognizant of the significance of the Bank of America's agreeing to pay a fine of over 17 BILLION DOLLARS to get the regulators off there backs in the matter of the sub-prime mortgage scandal. If that voluntary on their part, it is obvious they must feel they got a good deal paying a record fine for dirty dealing with the American public. This "biggest ever corporate fine" amounts to $56 for every man woman and child in America and is still nowhere near the wealth transferred to them by their crooked behavior. Would that indicate we needed stronger regulators or weaker ones? Dismal's argument is irrational. The regulators needed the power to make things right...break up these criminal organizations that masquerade as legitimate necessities of society. They collected instead a pittance in comparison to the damage done to our economy and more importantly, our people. BofA still holds the paper and defacto control of all the real estate involved in this rip off, and the fine is just one of the costs of "doing business," despite it being a record fine.

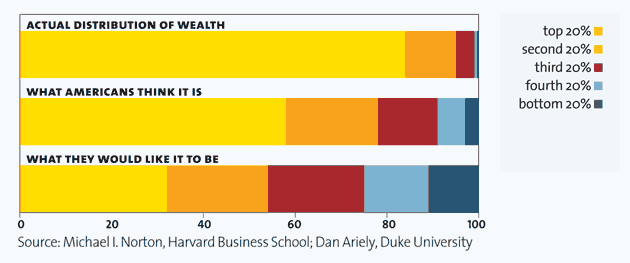

The problem is that government power in relationship to huge corporations needs to be increased by orders of magnitude and corporate control of government needs to be abolished. So do a number of these corporations. I frankly do not see a route to the resolution of the problem given that we are now a Corporatocracy. In other ages, it would be called fascism. Just look at our bloated military and security state and tell me we are not firmly in the grip of arbitrary uncaring people of wealth. I still vote, but honestly cannot give you the reason why I do so. I suppose it is just because of nostalgia.