Jarhyn

Wizard

- Joined

- Mar 29, 2010

- Messages

- 17,447

- Gender

- Androgyne; they/them

- Basic Beliefs

- Natural Philosophy, Game Theoretic Ethicist

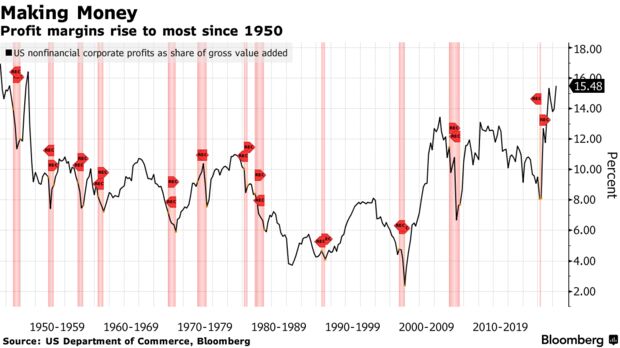

Economic sophistry is kind of expected TBH.US Corporate Profits Soar With Margins at Widest Since 1950

A measure of US profit margins has reached its widest since 1950, suggesting that the prices charged by businesses are outpacing their increased costs for production and labor.

After-tax profits as a share of gross value added for non-financial corporations, a measure of aggregate profit margins, improved in the second quarter to 15.5% -- the most since 1950 -- from 14% in the first quarter, according to Commerce Department figures published Thursday.

The data show that companies overall have comfortably been able to pass on their rising cost of materials and labor to consumers. With household budgets squeezed by the rising cost of living, some firms have been able to offset any slip in demand by charging more to the customers they’ve retained -- though others like Target Corp. saw their inventories swell and were forced to discount prices in order to clear them.

The surge in profits during the pandemic era has fueled a debate about whether price-gouging companies carry a share of the blame for high inflation -- an argument pushed by President Joe Biden’s Democrats. Most economists have been skeptical about the idea.

Economists are economists, at least in my mind and ostensible observation, because they seek on some level to justify the relationship they have with money.

The people who think about money more naturally are expected to care about having it more.

As a result, this would lead towards selection by economists towards their conflicted interest: to be skeptical of actions which apparently damp the power of individuals to accrue money even through unfair practices.

The problem is that on average, humans are largely the same: when there is money available, even when they don't need it, they take it.

Rarely do I see the person who gripes about entitlements turn down the money. Occasionally, and let's be honest more than occasionally, events happen which are designed to cull those who put principle over pocketbook: dirty cops live, honest cops die or are driven out.

Doing the right thing is usually doing the hard thing, after all. It tends to drive the proportion of people willing to live on principle down to the minimum principle needed to prevent disaster plus some SMALL number.

I think skepticism that companies increasing prices when an increase in the money supply happens is skepticism that water at STP is "wet". I also think trying to stop it is rather like trying to stop the movement of a planet. A lot of effort has been put into making any such attempt fail.