Jarhyn

Wizard

- Joined

- Mar 29, 2010

- Messages

- 17,427

- Gender

- Androgyne; they/them

- Basic Beliefs

- Natural Philosophy, Game Theoretic Ethicist

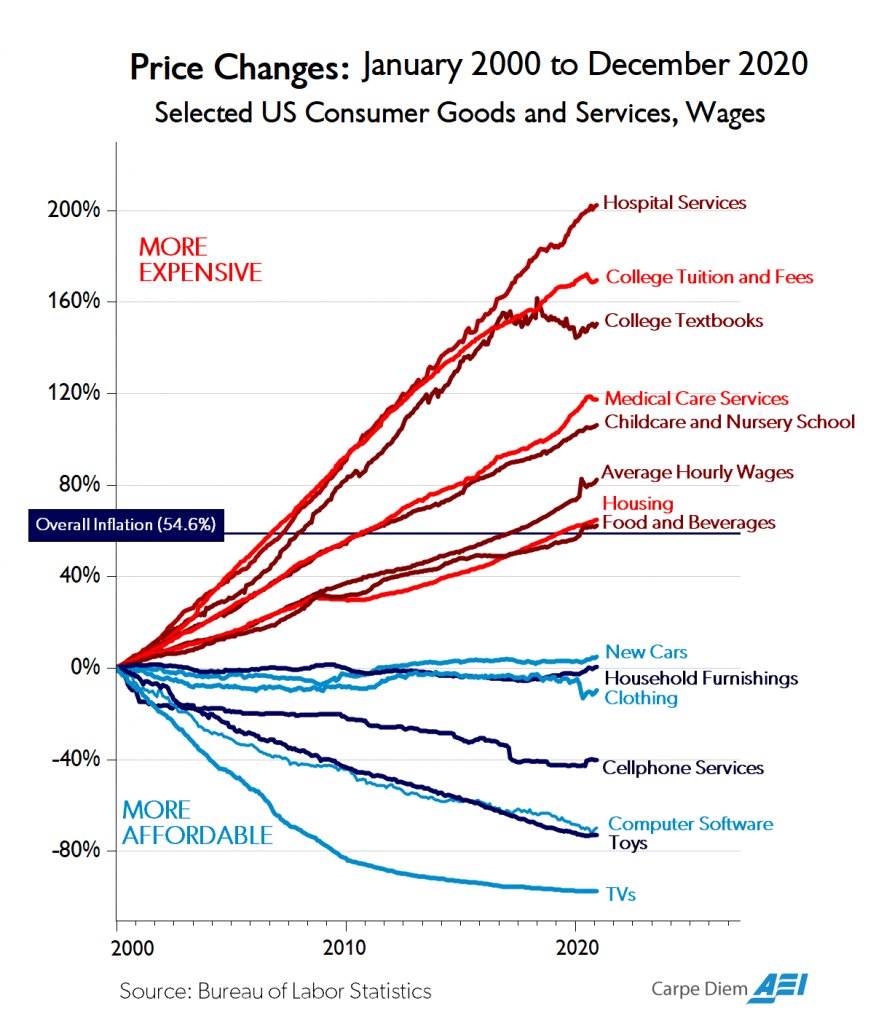

Just like plenty of people have won the lottery, plenty of people have survived jumping out of a plane without a parachute, and plenty of people walk away from a game of Russian roulette.Define ‘plenty.’Plenty of people with student debt have bought houses and had children. Next.Yes, something you can take a cheap pill to counteract the effects of, and adopt to resolve the legacy effects of, after almost a decade of experience and observation as to the effects of it in direct exposure is more of a measured decision than it could ever be to enter into a nondischargeable debt that will assuredly prevent you from ever affording a home or (adopting) children.

Non. Student loans don't eliminate your 'financial security'.And fewer people (a vanishing minority, in fact) have buyers remorse for losing their genitals after almost a decade of consultation, than losing their financial security after a 10 minute spiel in an admissions office.

Yes, some students we’re able to pursue university educations without incurring enormous student debt. Unfortunately too many are overburdened.