SimpleDon

Veteran Member

The bipartisan Senate budget deal will pass at least the Senate.

Then we are looking at a trillion dollar deficit in 2019, if it passes in the house. It appears that fiscal responsibility is only important when the Democrats are in power. That tax cuts and defense spending erase deficit concerns for the Republicans and that spending for social programs and infrastructure does the same for the Democrats.

The hypocrisy is breathtaking. The Republicans preached austerity during the Obama administration and the Democrats pointed proudly to their adherence to the sequester and revenue neutrality at the same time. Both hurt the economy and both delayed the recovery from the Great Recession. Now that the economy has slowly struggled back in spite of the best efforts of the government, with the exception of the Federal Reserve, both now embrace stimulus spending.

This all means that the Congress has done exactly the wrong thing for the economy in both of its phases. They met the recession with austerity and the good economy with a stimulus.

But it is going to produce an extremely undesirable consequence. When the federal government runs a deficit they create money that is spent into the economy. This is what creates inflation.

More precisely, the Treasury sells bonds to raise the money to spend. This method doesn't reduce the threat of inflation. The money used to purchase the bonds is money that is being redirected from savings to consumption spending by the government.

Savings, by definition, is money that is being diverted from consumption spending. It is money that doesn't impact the economy.

In this method of financing the deficit, the government does create new money, it is just in the form of Treasury bills.

The economy doesn't need a fiscal stimulus when the unemployment is 4%. It will create inflation.

And the Fed will proacatively raise interest rates to try to fight the inflation, which will disportantly hurt industries that depend on their buyers taking out large loans, at least in theory. But the dirty secret is that raising the interest rates to reduce inflation is losing its ability to impact inflation, just like lowering the interest rate to stimulate the economy had little effect during the Great Recession.

This is because the burden of fighting inflation this way now falls almost completely on the employees. The companies lay off people to preserve their profits, secure that they can rehire people when the economy picks up because so many people are laid off in response to a downturn in their industry. Rehire employees often at lower wages than they were paying before.

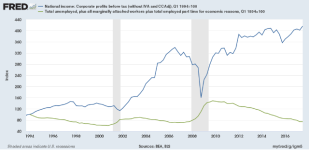

Here is corporate profits before taxes and unemployment, U6 - including marginally employed and underemployed part time. Corporate profits recovered their pre-recession level from the Great Recession in the first quarter of 2010. U6 hasn't still dropped to its pre-recession value, but it is close.

Corporate profits have become almost recession proof, they recovered quickly from the Great Recession, the worst since the great depression. An interest rate increase by the Fed will hardly cause a ripple in the rate of corporate profits.

The corporations can now defend against higher interest rates by sacrificing a part of their profits to buy down the customers interest rate for the big ticket purchase of a home, a car or a major appliance, blunting the inflation fighting effect of the increase in the interest rates. And the neoliberals prevent us from using the most effective way of fighting inflation, by raising taxes.

Then we are looking at a trillion dollar deficit in 2019, if it passes in the house. It appears that fiscal responsibility is only important when the Democrats are in power. That tax cuts and defense spending erase deficit concerns for the Republicans and that spending for social programs and infrastructure does the same for the Democrats.

The hypocrisy is breathtaking. The Republicans preached austerity during the Obama administration and the Democrats pointed proudly to their adherence to the sequester and revenue neutrality at the same time. Both hurt the economy and both delayed the recovery from the Great Recession. Now that the economy has slowly struggled back in spite of the best efforts of the government, with the exception of the Federal Reserve, both now embrace stimulus spending.

This all means that the Congress has done exactly the wrong thing for the economy in both of its phases. They met the recession with austerity and the good economy with a stimulus.

But it is going to produce an extremely undesirable consequence. When the federal government runs a deficit they create money that is spent into the economy. This is what creates inflation.

More precisely, the Treasury sells bonds to raise the money to spend. This method doesn't reduce the threat of inflation. The money used to purchase the bonds is money that is being redirected from savings to consumption spending by the government.

Savings, by definition, is money that is being diverted from consumption spending. It is money that doesn't impact the economy.

In this method of financing the deficit, the government does create new money, it is just in the form of Treasury bills.

The economy doesn't need a fiscal stimulus when the unemployment is 4%. It will create inflation.

And the Fed will proacatively raise interest rates to try to fight the inflation, which will disportantly hurt industries that depend on their buyers taking out large loans, at least in theory. But the dirty secret is that raising the interest rates to reduce inflation is losing its ability to impact inflation, just like lowering the interest rate to stimulate the economy had little effect during the Great Recession.

This is because the burden of fighting inflation this way now falls almost completely on the employees. The companies lay off people to preserve their profits, secure that they can rehire people when the economy picks up because so many people are laid off in response to a downturn in their industry. Rehire employees often at lower wages than they were paying before.

Here is corporate profits before taxes and unemployment, U6 - including marginally employed and underemployed part time. Corporate profits recovered their pre-recession level from the Great Recession in the first quarter of 2010. U6 hasn't still dropped to its pre-recession value, but it is close.

Corporate profits have become almost recession proof, they recovered quickly from the Great Recession, the worst since the great depression. An interest rate increase by the Fed will hardly cause a ripple in the rate of corporate profits.

The corporations can now defend against higher interest rates by sacrificing a part of their profits to buy down the customers interest rate for the big ticket purchase of a home, a car or a major appliance, blunting the inflation fighting effect of the increase in the interest rates. And the neoliberals prevent us from using the most effective way of fighting inflation, by raising taxes.