Derec

Contributor

Qasim Rashid seems to be a professional activist. And he has no idea what he is talking about. There is definitely a high inflation and there is definitely a labor shortage.

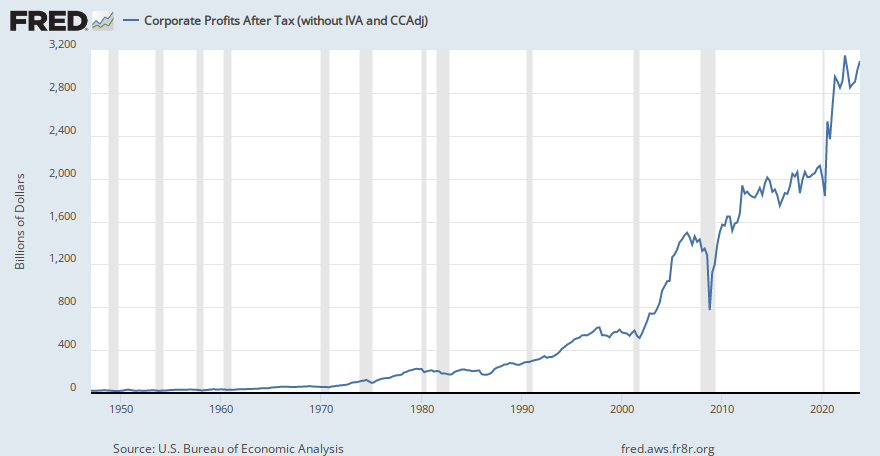

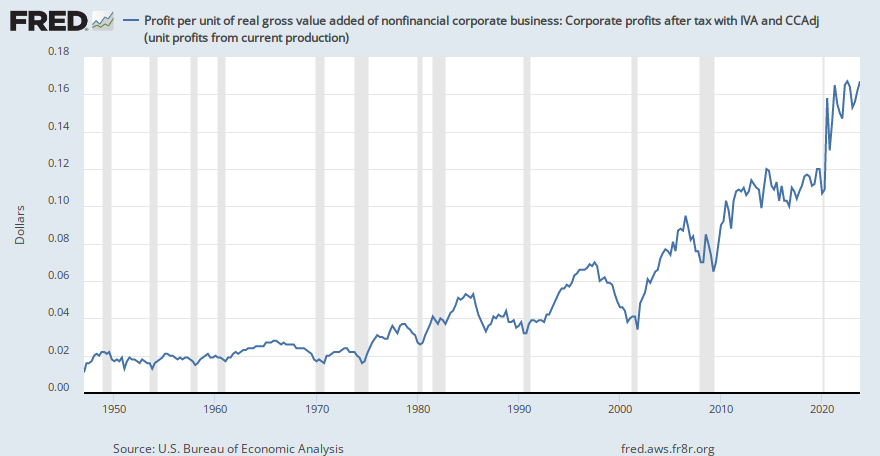

As far as increasing profits in 2021, what were the profits in 2020? It's easy to have big increases from a bad baseline.

As to inflation, the price of coffee beans increased substantially.

Coffee prices hit a 10-year high, rising more than any other commodity this year

That is inflation. But Starbucks et al are evil, I guess, for being profitable businesses.

As far as increasing profits in 2021, what were the profits in 2020? It's easy to have big increases from a bad baseline.

As to inflation, the price of coffee beans increased substantially.

Coffee prices hit a 10-year high, rising more than any other commodity this year

That is inflation. But Starbucks et al are evil, I guess, for being profitable businesses.