lpetrich

Contributor

How the supply chain caused current inflation, and why it might be here to stay | PBS NewsHour - Nov 10

4 reasons Americans are still seeing empty shelves and long waits – with Christmas just around the corner - Oct 12

But will that soon end?

Indicators Hint the Supply Crisis Is Over and Inflation Will Cool Soon

notingConsumer prices soared in October 2021 and are now up 6.2% from a year earlier – higher than most economists’ estimates and the fastest increase in more than three decades. At this point, that may be no surprise to most Americans, who are seeing higher prices while shopping for shoes and steaks, dining at restaurants and pumping fuel in their cars.

4 reasons Americans are still seeing empty shelves and long waits – with Christmas just around the corner - Oct 12

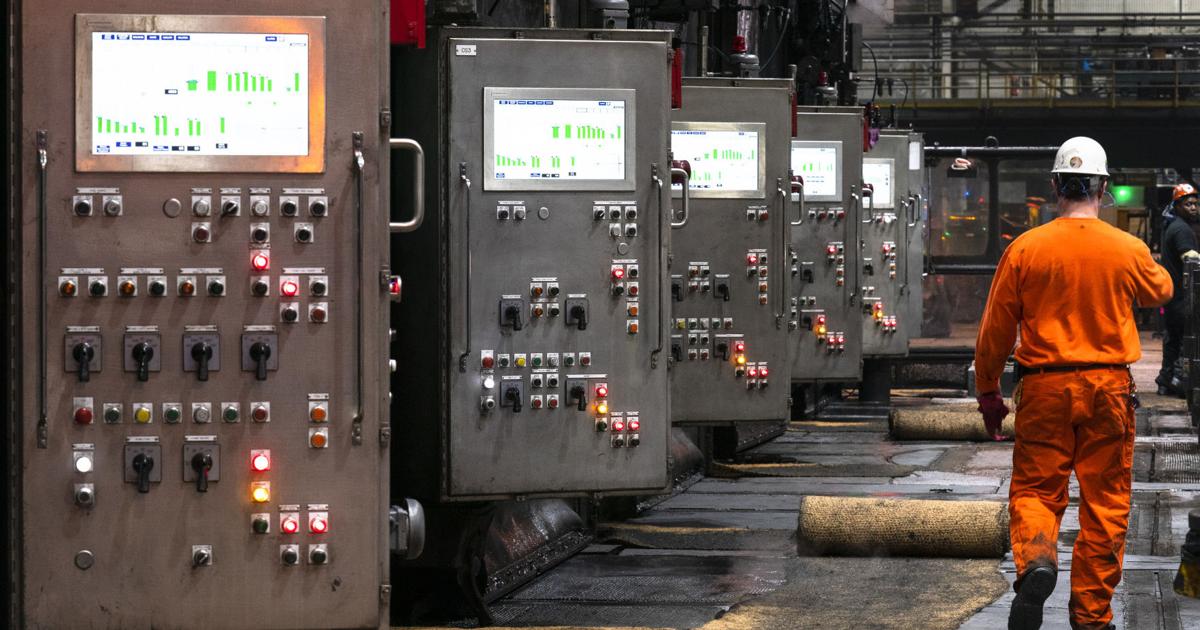

Walk into any U.S. store these days and you’re likely to see empty shelves.

Shortages of virtually every type of product – from toilet paper and sneakers to pickup trucks and chicken – are showing up across the country. Looking for a book, bicycle, baby crib or boat? You may have to wait weeks or months longer than usual to get your hands on it.

I recently visited my local ski shop and they had hardly a boot, ski, goggle or pole to speak of – two full months before ski season begins. The owner said he’s normally close to fully stocked around this time of the year.

But will that soon end?

Indicators Hint the Supply Crisis Is Over and Inflation Will Cool Soon

- Businesses have fallen short of meeting consumer demand this year. That drove prices sharply higher.

- Recent US manufacturing indicators show supply starting to match Americans' spending.

- Bottlenecks at ports are also easing, hinting the months-long supply crisis is finally wrapping up.