Once the petition was filed, Amazon called in the union-avoidance storm troopers, hiring a law firm well versed in keeping unions out. Their first task was to create legal issues to delay the actual vote, hoping to use the additional time to convince workers to vote against the union. The RWDSU had filed a petition with the Labor Board to represent a unit of 1,500 workers, mostly pickers and packers, at the Bessemer facility. Amazon’s lawyers, using a well-worn employer tactic, countered that the lawful unit had to include all workers at the facility, including seasonal employees — approximately 5,800 workers in total — about four times the number the union had petitioned for.

Under NLRB rules, a disagreement about who must be in the unit — an “appropriate unit” in NLRB-speak — requires a hearing. Hearings take time. Each job category is evaluated as to whether it is more or less like another job category — is the job in the unit or out? The employer has all the records, which the union has to file subpoenas to get, leading to more fights and costing more time. To make matters worse, hearing days don’t necessarily run consecutively. As a lawyer for the Communications Workers of America, I once did such a hearing that lasted for almost a year.

Employers usually seek a bigger unit to buy time or scare off the union. But sometimes they try to dilute the pro-union vote by arguing that a job classification with a lot of union support should be out of the unit, or a job with little union support should be added. If the board agrees with the company on the larger or different unit, the union might not have enough cards to support the petition, or will walk away because they can’t win.

The Consultants Move In

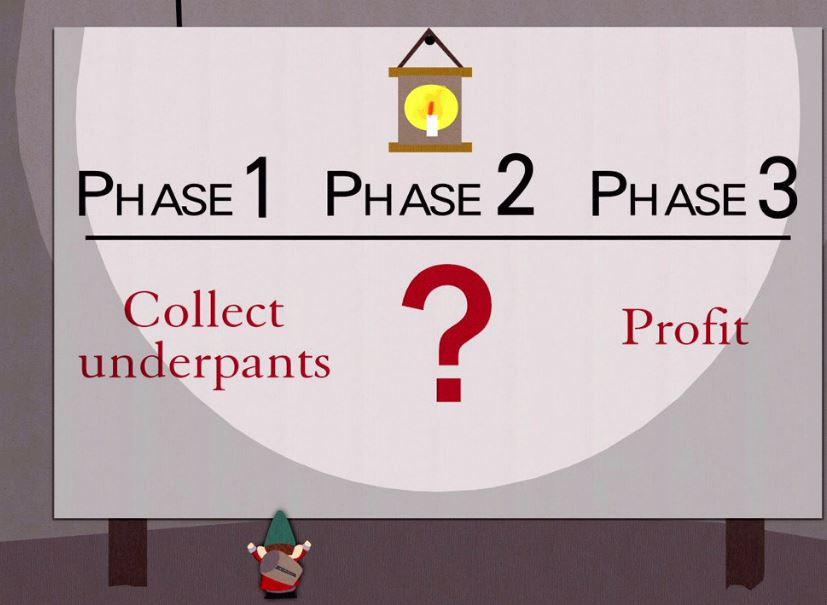

Even if the board ultimately sides with the union while the parties are fighting all of this out, another wing of the union-avoidance machine moves in: the consultants, often called persuaders. Their job is to convince workers of any combination of the following: you don’t need a union; you don’t want a union; unions can’t help; unions are costly; unions are scary; unions are corrupt; unions don’t care about you; you will end up on strike; you could get fired. And, Vote No!

The more time the lawyers get, the more time the consultants have to hammer home their message. In this case, RWDSU stopped Amazon’s attempt to drag things out by agreeing to the 5,800-worker unit. This ended the big stall, but it also makes victory for the workers and the union much more difficult.

Nonetheless, the persuaders moved quickly. At Bessemer, they’ve plastered “Vote No” signs everywhere, even in bathroom stalls. (“You go to the bathroom for privacy,” one worker told labor reporter Steven Greenhouse. “But then you have a flyer right in your face. That feels like a type of harassment.”) Workers have been required to attend weekly anti-union meetings — called captive audience meetings — where they are told how terrible unions are.

Amazon created a special website for Bessemer workers — doitwithoutdues.com. Animated characters and workers holding their thumbs up assure the Bessemer workers that the company already has them covered with good pay and benefits, and that if they pay dues (alleged to be $500 without any indication of a time period), “it won’t be easy to be as helpful and social with one another.” It then tells workers that they can ask for their cards back and that they should “reclaim” their voices. Much of the information is wrong, misleading, or silly — but providing facts is not the goal. Getting workers to vote “no” is the point.

I expressed no opinion on how much "money" that would produce. My post was intended solely to point out the gross misconceptions in YOUR post.