Swammerdami

Squadron Leader

What’s bizarre about the “inflation is caused by corporate profits” mantra is how new it is. Cannot recall a time prior when anyone thought that. Inflation had been under control for decades, times during which oil companies and others had huge profits. I guess when the ruling party can’t defend its terrible governance it’s gotta conjure new bullshit.Correlation does not imply causation.

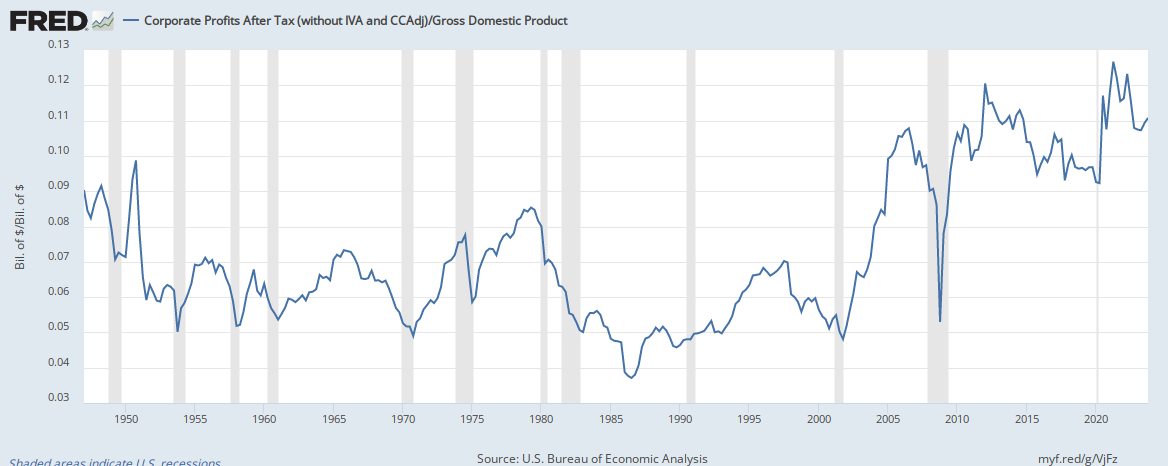

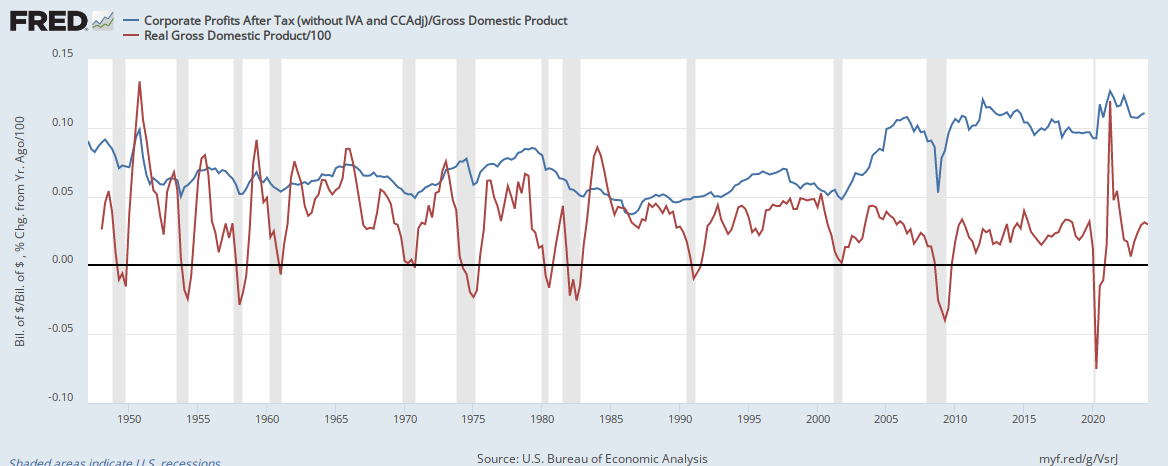

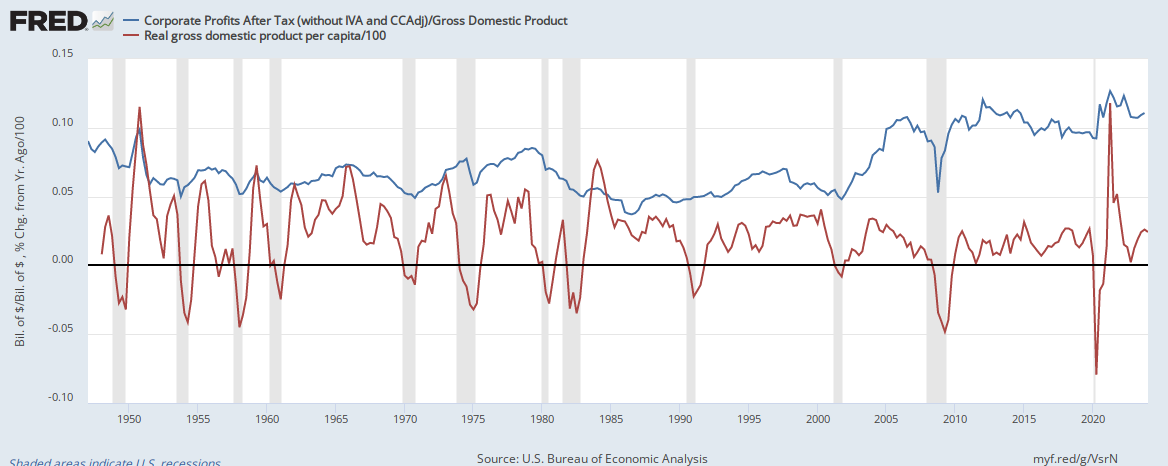

Perhaps the "bizarre" comments are motivated by — gasp! — the ACTUAL DATA. Here are corporate profits as a percentage of GDP. They barely nosed above 8% during Carter's term (was this also corporations taking advantage of inflation?), and averaged less than 6% during the Clinton Boom. But then profits soared during the first Bush-43 recession and in the pro-bank aftermath of his second, great recession. They retreated to 9% by 2020 but during the recent inflationary epoch have soared all the way to 12% and set a record.

At the risk of stating the obvious, the total pie will always be 100% exactly. The bigger share of the pie that goes to corporate profits, the smaller the cut for wages and salaries.

As if their massive lobbying isn't enough.

As if their massive lobbying isn't enough.