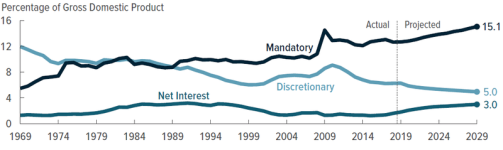

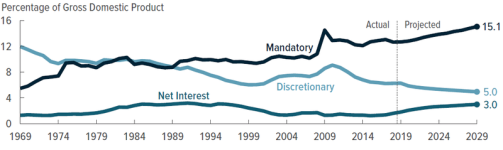

I know it's not for a single year. But over 4 years it is still $1.5E12/a. That would be almost as much as the entire discretionary spending in 2020.

[ ATTACH=CONFIG]34216[ /ATTACH] [snipped attach to ease browsing]

That is highly irresponsible level of spending, especially with increasing inflation

This graph would be much more realistic and useful if they separated the payroll tax revenue and the mandatory spending by payroll tax funding away from the rest of the budget.

It would give a much clearer picture of the items up for DEBATE.

Outlays ($6.6T) are nearly

double Revenues! ($3.4T) Wild!

Much of the shortfall is due to big cuts in the taxes that multi-millionaires and corporations pay, first under Bush-43 in response(!) to 9-11, then and in spades during the McConnell-Kavanaugh-Hannity circus.

A trillion for billionaires here; a trillion for corporations there; after a while we're talking real money!

And by the way, the chart shows only $0.9T for

non-defense discretionary outlay ...

and that includes some VA benefits!

Amateur cynics often ignore that the

quality of spending is important. Spending to save that Miami condo would have been worthwhile, or fixing Flint's water, or Georgian's voting rights. Funds diverted to overseas wars, grants to parochial schools at the expense of public schools, Hard-boot policing, and other grifts and grafts — spending the GOP likes, in other words — will return less than would be returned by smart investments.

Childcare, healthcare, improved education, repaired infrastructure, more efficient transportation options: Such programs benefit the public and enhance prosperity and productivity. To call them inflationary, compared with billionaire-driven spending, is to ignore the whole purpose of economic society in a democracy.

The government has four dials it can manipulate:

* stimulus spending

* money supply

* short- to mid-term interest rates

* tax hikes on rich and corporations

IF Joe Manchin keeps tax hikes off the table, THEN Jerome Powell must watch inflation expectations very closely. Each $1 trillion in additional spending will probably necessitate another 1+% hike in interest rates. If Powell acts to defeat inflation then a recession may result but stagflation can probably be avoided, at least for the next 3 to 5 years. Jones, Hannity and other right-wing liars may stoke up inflation fears to sell more sex creams or whatever, but the adverse effect is more likely to be recession than inflation.

I've attached another chart from the same source as the two pie-charts. This one graphs the historical split among budget categories. Note that Interest (as a % of GDP) fell under Clinton and under Obama, but is now projected soon to exceed what it was during the Carter-Reagan inflation.

Note also how discretionary has shrunk and shrunk (till regulators operate with skeleton crews and are unable to keep up with responsibilities).

https://en.wikipedia.org/wiki/File:Expenditures_of_US_Federal_Budget.png