SimpleDon

Veteran Member

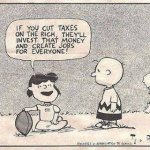

He is now proposing to allow anyone who can arrange their income as a S class or a LLC corporation to be taxed at the 15% rate.

I read that as well, but it's not mentioned in his 12-bullet-point "plan"....

I have to admit that I haven't read the complete plan. I got distracted by a shiny object half way through the page.