The problem is the combination of the Red and Blue ideologues dominating society, both of which are equally to blame. The proper solution is to have some tax increases and spending cuts.

. . . even in the late 20th century, it was the GOP specifically which consistently strove to increase the federal debt. Reagan, Bush-43 and Trump all increased the debt hugely with their tax cuts on the rich. Obama, Biden and especially Clinton made much progress on deficit reduction.

Cherry-picking facts: Both Obama and Biden had a roller-coaster ride downhill following a crisis which drove up deficits during a severe crisis. And Clinton was aided by the high-tech boom of the '90s, which he was no more the cause of than Al Gore was the inventor of the Internet.

I'm curious about Lumpenproletariat's understanding of the two political parties.

The Blues want to provide poor schoolchildren with nutritious lunches. The Reds want to ban cartoons depicting girls in boys' clothing. Same-same?

So the only issue is: Which crusade of fanatics is nastier -- the Republican Demagogues or the Democrat Demagogues? And how does answering this question solve the debt crisis?

Overall maybe the Repubs have been nastier than the Demos. So what?

The Blues want to increase taxes on the rich, though these higher rates will still be lower than any rate in the previous century. The Reds want to reduce taxes on the rich even further, despite record-setting income inequality already. Same-same?

The Blues have proposed a budget which reduces the deficit sharply.

Only in one year, 2021 (or 21-22), after the sharpest deficit increase in history. Otherwise Biden's budget(s) keep the deficit the same or increase it slightly, even though it has not recovered from the record-high 2020 level.

The Reds haven't even proposed a budget since the "Burn it down" faction led by Boebert, Gaetz and MTG may veto whatever blackmail scheme the "moderates" come up with. Same-same?

Let's agree that Repubs are a little nastier. But this Blue partisan talking-points propaganda doesn't answer how the debt problem is to be solved.

If all the above partisan talking points are accurate, then the facts would show that spending today is a smaller % of the economy than it was 20 / 50 / 80 years ago. And only the debt or deficits are a higher % of the total economy (debt/GDP or deficit/GDP), meaning all this higher debt is due only to tax decreases, or revenue loss, so that the same level of needed spending has been paid for with less and less revenue. So this is claiming that total spending has not increased (as a % of the economy), but the taxes have decreased (as a % of the economy).

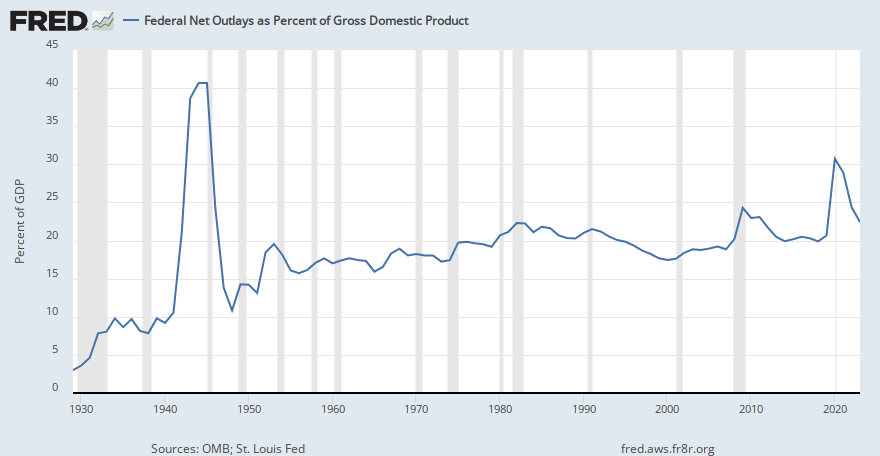

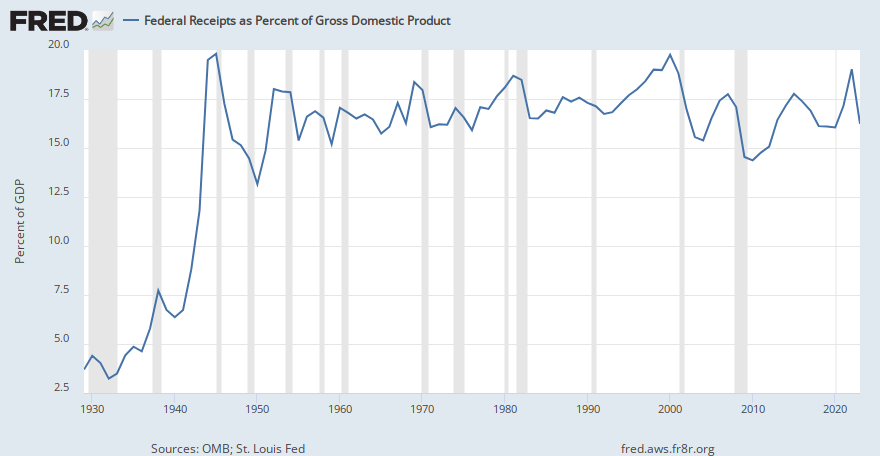

Here are 2 graphs which probably tell the truth about what's causing the higher debt -- tax cuts or spending increases (though there are other sources for this which might give the data more accurately, in which case someone can provide it):

Graph and download economic data for Federal Net Outlays as Percent of Gross Domestic Product (FYONGDA188S) from 1929 to 2024 about outlays, Net, federal, GDP, and USA.

fred.stlouisfed.org

Graph and download economic data for Federal Receipts as Percent of Gross Domestic Product (FYFRGDA188S) from 1929 to 2024 about receipts, federal, GDP, and USA.

fred.stlouisfed.org

One graph shows the ratio of tax receipts to GDP (as a % of GDP), while the other shows the ratio of outlays/spending to GDP (as a % of GDP). You could argue that the taxes/GDP was lower before WW2, and after that was virtually flat, because it rose sharply for WW2 and then never decreased back to the pre-War level.

Both graphs are flatter than one might expect. But both rise (taxes have not decreased (as a % of the economy)), and of the two, the taxes to GDP graph is a bit flatter (or zero rise overall since the War). Meaning both taxes and spending have increased as a % of GDP (as a general pattern, not for every single year), and the spending has increased at a faster rate than the taxes have increased.

So the Blues partisan rhetoric makes sense only if it's proved that the spending increases (as a % of the economy) are necessary, so spending on gov't programs has to become an ever larger and larger percent of the economy, and so it follows that taxes to pay for it must also become an equally larger and larger part of the economy, and those tax increases (as a % of the economy) have not been enough.

But taxes have increased (as a % of the economy), not decreased, as Swammerdami implies.

higher taxes on the rich?

(If the argument is not that taxes generally have decreased, but only taxes on the rich, you still cannot deny that

spending increases are also a cause of the higher debt. Also, just because you can show some higher tax

rates at certain points, this does not show that there were higher tax

payments from the rich. You need a graph or chart showing the actual amount of revenue received from the higher-income taxpayers, and take account of the enforcement or non-enforcement of the tax law. Furthermore, those clamoring for higher taxes on the rich must stop obsessing on higher income tax only, but must recognize other forms of taxing the rich which are less costly to enforce.)

So the accurate Blue partisan rhetoric cannot be that taxes have decreased (as a % of the economy) due to tax cuts and have thus caused the increased debt. It is the higher spending (higher as a % of the economy) which has caused the higher debt, or

higher spending not accompanied by enough higher taxes to pay for it.

And no one has made the case from any empirical evidence that the public spending has to increase faster than the economy grows, which is basically Swammerdami's argument.

(Unless someone has data to show that taxes/GDP has actually decreased.)

It's not about

the

Sons of Light (Demos?) vs. the

Sons of Darkness (Repubs?).

So therefore, the only resolution to the debt crisis comes from those who recognize the need for

both spending cuts as well as tax increases. Partisan fanatics on either side, insisting on NO SPENDING CUTS or on NO TAX INCREASES are both to blame for the crisis and for whatever bad consequences are going to come from this. (Also to blame are those fanatics who say there is

no waste which can be cut from the spending programs. Cutting waste (or finding new ways to cut waste) is also a necessary part of the solution. There are ways to do this, but the partisan Blue and Red fanatics on both sides are oblivious to any serious possibility to address this point, further showing that these two groups in combination are to blame, and only when they are replaced by something better can there ever be any real solution to the budget issues.)

You cannot prove that the spending needs today are greater (as a % of the economy) than they were 20 or 50 or 80 years ago. The need is to equally cut the spending and increase the taxes to pay for the programs. All those who insist that it's only one or the other are the culprits who are unpatriotically preventing this impasse from being resolved -- i.e., the Blue partisans and Red partisans, insisting on NO SPENDING CUTS and on NO TAX INCREASES respectively. Since both are insisting emphatically, without compromise, on having their absolutist demands met, they are both equally to blame.

Repeating the worn-out talking-points, Blue or Red, about which Party was the nastier of the two 50 years ago is totally irrelevant. As long as the only point you can make is that the other Party is nastier, you're part of the problem rather than the solution.