I don't buy it. Half the country dosn't pay their share of taxes. Trump is one of the worst. And yet we rise up in outrage at someone legally not paying "their fair share in taxes" as you define it. Something else is going on here.

One of the things going on HERE is that some people arguing against a wealth tax keep using examples of "If I made ten dollars an hour and you made a hundred dollars an hour", or "If your house was worth 600k...", then ask if YOU should be taxed on its increased value*.

THAT IS NOT ABOUT ANYONE TO WHOM A WEALTH TAX WOULD APPLY.

Wealth tax, in my mind, is not about people making ten or a hundred - or even a thousand dollars an hour. It's about people making tens of thousands, hundreds of thousands or MILLIONS of "on paper" dollars per hour whether or not they actually work.

IMO, any reasonable wealth tax would kick in only on increases in paper wealth above some threshold like perhaps 100x the median individual net worth. NOBODY would be hurt by those taxes.

So those are totally strawman arguments.

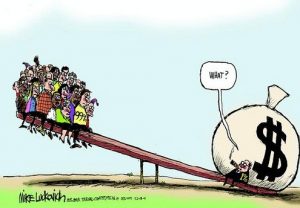

Mega-billionaire individuals are like economic black holes, sucking up all the wealth in their vicinity and re-distributing bits of it as they see fit while hoarding vast amounts to allow their progeny to do the same.

Sure, I like space exploration, and I'm thrilled for Chef José Andrés having been granted $100M. Those are crumbs off the plate, and IMO most of the entire plate is rightfully owed to the American taxpayers who made up the difference in increased taxes paid and reduced government services.

Another way to examine the American inequality trend that Bomb#20 for one denies, is to examine the difference between average and median net worth in the US.

I'm having a hard time finding net worth stats, but I suspect they will reflect the income inequality increases shown in this graph:

* in fact I AM taxed on its increased value