Canard DuJour

Veteran Member

That is in general how monetary sovereign govts already spend, with taxation and interest rates controlling inflation. If you mean without controlling inflation, no one is suggesting that.Canard DuJour said:Indeed, so if the economy gets stuck in a low-wage/low-productivity rut, direct fiscal stimulus can correct that. Several historical examples were given in the video link you've apparently edited out.

I agree that there are times injecting money into the economy is the right thing to do. That doesn't mean you can do that in general as a way of funding the government.

Not even 2% since the crash. Yet GDP growth averaged about twice that back back in pre-neoliberal days when central banks prioritised full employment. The New Deal, combined with the deficit spending of WWII, resulted in the greatest, most widespread burst of growth, progress and prosperity in American history — before or since. Pretty much the same happened across the OECD with GDP growth averaging >4% per year in the 1950s, and nearly 5% in the 1960s, compared with 3% in the 1970s and 2% (if that) since the 1980s.Meaning..?

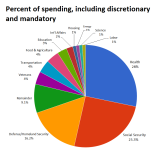

GDP grows on average a bit over 2%/year. Federal tax revenue is a bit over 20% of GDP/year. Thus if you want to fund the government with only what you can inject without causing harm you need to cut out 90% of government spending.

On the contrary, taxes do not fund federal govt spending in the first place.Fine. Tax, raise interest rates or cut spending as and when inflation kicks in. Don't hamstring the economy with an artificial scarcity of money just because some people don't like public spending.To spend more than that you have to take it back out of the economy somehow.

I note your first option is tax--but this was being presented as an alternative to tax!

Then it is indeed, as I said, a means of controlling inflation. Do try to maintain context.As for raising interest rates, that's not going to do any good. Raising interest rates is about slowing the rate money moves around and thus lowering the effective money supply.

Even if govt "borrowing" were dependent on credit markets - which it isn't - this would make no sense at all.To overcome this huge injection of cash you'll have to raise them a lot every year. Pretty soon nobody will borrow and your control breaks.

On the contrary, you got decades of boom, then stagflation which was short term and had as much to do with geopolitical oil shocks as wage/price spirals. We now have the opposite problem.And we aren't hamstringing the economy. We are trying to keep it going smoothly--the supply of money matches the goods & services available so prices stay stable. What you seem to be advocating (accepting inflation to boost the economy) was already tried--and we got stagflation. The gains are short term, the pain doesn't go away nearly so easily.