I read about this a lot. For example some of the top google hits for this are:

http://www.politifact.com/florida/s...re-and-social-security-not-defense-are-drivi/

http://www.politifact.com/truth-o-m...says-medicare-and-medicaid-are-largest-defic/

http://www.nationalreview.com/corne...d-medicare-social-security-spending-are-cause

I did some looking into the Trustee reports for social security and medicare. I posted this about it on another forum:

The fact is that while medicare has contributed about $3.2 billion to the 2015 deficit, taken together social security and medicare are net reducers of the deficit.

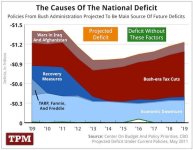

So all you deficit hawks keep your hands off of medicare and social security and go after the real drivers of the debt and deficit which I would guess would be military spending since it is by far the largest area of discretionary spending.

http://www.politifact.com/florida/s...re-and-social-security-not-defense-are-drivi/

http://www.politifact.com/truth-o-m...says-medicare-and-medicaid-are-largest-defic/

http://www.nationalreview.com/corne...d-medicare-social-security-spending-are-cause

I did some looking into the Trustee reports for social security and medicare. I posted this about it on another forum:

ksen said:For example, one of the comments says that Medicare and Social Security are two of the biggest deficit drivers.* Well, genius, Medicare, according to the Trustees report, only contributed $3.2 billion to the deficit with total income for 2015 of $644.4 billion and total expenses for 2015 of $647.6 billion.

Meanwhile over in the Social Security Trustee's report the OASDI funds (Social Security and Disability) are still in the black by $25 billion with income of $884.3 billion and expenses of $859.2 billion.

Taken together OASDI and Medicare actually reduce the deficit by around $21 billion.

I probably should never have looked at those reports because the Trustees report what tax rate would be needed to correct any long term imbalances.* To make Medicare stable for the next 75 years would mean increasing Medicare payroll taxes by 0.73 percentage points.* Currently Medicare payroll taxes are 2.90% (1.45% paid by the employee and 1.45% paid by the employer).* To "fix" Medicare would require that percentage to to to 3.63% (1.815% for the employee and 1.815% for the employer).

To "fix" Social Security fro the next 75 years would mean upping the current OASDI tax from 12.40% (6.2% for employee and 6.2% for employer) to 15.02% (7.51% for employee and 7.51% for employer).* I think that's also assuming the current $127,200 salary base limit.

So all this arguing and wringing of hands and complaining and fearing the destruction of the United States is over a measly 3.35% increase in payroll taxes split 50/50 between the employee and employer (1.675% each).

SAD!

The fact is that while medicare has contributed about $3.2 billion to the 2015 deficit, taken together social security and medicare are net reducers of the deficit.

So all you deficit hawks keep your hands off of medicare and social security and go after the real drivers of the debt and deficit which I would guess would be military spending since it is by far the largest area of discretionary spending.