If it's actually a bribe it's reportable income. Those wall street traders definitely have to report those bonuses as income.Yes, if they total more than $20 in a month.Question: Currently while tips ARE taxed, are employers like restaurants required to track employee tips?

Really? Pardon my French but this is perhaps the most asinine example of the caricature Amerika and its Rich-better-than-Poor mentality that I've ever seen.

Judges and Governors aren't required to report bribes even if in excess of $9 million. Wall St. traders get bonuses of up to $4 million IIRC before certain restrictions kick in.

Yet the lady at the cheapest diner lucky to get 75¢ a day in tips must report that. I clicked jonatha's link and find that that means report to her employer (so he can deduct the 75¢ from her paycheck?) She must report the tip to the IRS no matter how small it is. Elites routinely cheat the government out of billions(?) collectively in SocSec they do NOT deduct for their (often undocumented) servants. Bankers earn billions in bonuses every time the financial system almost collapses and needs a government bail-out. But the gummint sure wants to know about the 75¢ tip that waitress got!

Good grief.

-

Features

-

Friends of IIDBFriends Recovering from Religion United Coalition of Reason Infidel Guy

Forums Council of Ex-Muslims Rational Skepticism

Social Networks Internet Infidels Facebook Page IIDB Facebook Group

The Archives IIDB Archive Secular Café Archive

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Day without stupid: redux

- Thread starter Deepak

- Start date

Swammerdami

Squadron Leader

If it's actually a bribe it's reportable income. Those wall street traders definitely have to report those bonuses as income.

Did Clarence Thomas report the gifts and perks he got, totaling over $4 million in value? If not, have tax evasion charges been filed?

Those wall street traders definitely have to report those bonuses as income.Bankers earn billions in bonuses every time the financial system almost collapses and needs a government bail-out. But the gummint sure wants to know about the 75¢ tip that waitress got!

I never implied differently. I was merely comparing scale. The gummint's insistence that tips averaging 75¢/day must be reported to employer still seems like poor perspective. I'm sure the many $10,000+ evenings entertaining traders at Manhattan strip clubs are ignored by the tax man.

Last edited:

Swammerdami

Squadron Leader

Those wall street traders definitely have to report those bonuses as income.

I never implied differently. I was merely comparing scale. The gummint's insistence that tips averaging 75¢/day must be reported to employer still seems like poor perspective. I'm sure the many $10,000+ evenings entertaining traders at Manhattan strip clubs are ignored by the tax man.

Think I'm exaggerating? Google "Amex bill at Manhattan strip club." The first hit shows a $241,000 charge for one evening's entertainment. I think it was one executive entertaining 3 or 4 clients. The other hits were solo adventures: $28k, $20k. One guy was billed $50k and thought he'd spent only a paltry $5k. And that Googling only shows disputed bills for one particular credit card brand.

The IRS knows these entertainers prance around letting gentlemen stuff banknotes in their panties. (I think they throw the $20's on the floor to make room for more $100's) The IRS probably gets its cut when credit card billing is involved, but I suspect many of the dancers stuff a few Benjamins into their secret shoe-box the IRS doesn't know about. More than 75¢ anyway.

The company whose bill was $241,000 may have enjoyed a big write-off, but what about the clients who enjoyed a pleasant, if over-priced perk? Do they report this "bribe" or "kick-back" and pay taxes on it?

And please do NOT complain about "double taxation." Taxation is the rule, not the exception. The stripper spends a Benjamin at the beautician to look pretty for her next shift. The beautician hires an accountant to help her track the (75¢?) tips her assistants get; the accountant pays fees to Wall Street on his stock funds. It's all the same Benjamin floating around in circles.

On a personal note, I really like you @Loren Pechtel ! Politically you're a moderate, just like me. But you are consistently touting right-wing misconceptions ("supply-side", the Ds are more to blame than the Rs for inflation, etc. etc.) You think you're an economics expert, yet haven't even a clue about "Money."

Yeah, stripping is probably the biggest issue with tip reporting. Lots of cash tips and nothing to cross-check (with restaurants it's reasonably predictable the ratio of tip to check size.) I don't think there's all that much that can be done. (But note your $50k was credit card--that's buying expensive alcohol, not tipping dancers.) I doubt there's a good answer that won't hurt their income. It's not like the casinos where everything is done in tokens and the procedures are designed so dealers never have the tokens in their possession.Those wall street traders definitely have to report those bonuses as income.

I never implied differently. I was merely comparing scale. The gummint's insistence that tips averaging 75¢/day must be reported to employer still seems like poor perspective. I'm sure the many $10,000+ evenings entertaining traders at Manhattan strip clubs are ignored by the tax man.

Think I'm exaggerating? Google "Amex bill at Manhattan strip club." The first hit shows a $241,000 charge for one evening's entertainment. I think it was one executive entertaining 3 or 4 clients. The other hits were solo adventures: $28k, $20k. One guy was billed $50k and thought he'd spent only a paltry $5k. And that Googling only shows disputed bills for one particular credit card brand.

The IRS knows these entertainers prance around letting gentlemen stuff banknotes in their panties. (I think they throw the $20's on the floor to make room for more $100's) The IRS probably gets its cut when credit card billing is involved, but I suspect many of the dancers stuff a few Benjamins into their secret shoe-box the IRS doesn't know about. More than 75¢ anyway.

The company whose bill was $241,000 may have enjoyed a big write-off, but what about the clients who enjoyed a pleasant, if over-priced perk? Do they report this "bribe" or "kick-back" and pay taxes on it?

And please do NOT complain about "double taxation." Taxation is the rule, not the exception. The stripper spends a Benjamin at the beautician to look pretty for her next shift. The beautician hires an accountant to help her track the (75¢?) tips her assistants get; the accountant pays fees to Wall Street on his stock funds. It's all the same Benjamin floating around in circles.

On a personal note, I really like you @Loren Pechtel ! Politically you're a moderate, just like me. But you are consistently touting right-wing misconceptions ("supply-side", the Ds are more to blame than the Rs for inflation, etc. etc.) You think you're an economics expert, yet haven't even a clue about "Money."I suggested you fight your ignorance by skimming, say

Money supply. Have you done that yet?

I generally support old school Republican economics. Not the modern garbage. On social stuff I'm very much a you-be-you, the state should only get involved if a non-consenting individual is involved.

Swammerdami

Squadron Leader

Perhaps you guys are tired of all the links to YouTubes I post, but this one is almost Unbelievable!

Mike Lindell shaves off his moustache (for just $2 you can watch!) to go to the DNC in disguise. Once there, he debates a 12 year-old kid ... and LOSES the debate!

Mike Lindell shaves off his moustache (for just $2 you can watch!) to go to the DNC in disguise. Once there, he debates a 12 year-old kid ... and LOSES the debate!

Shadowy Man

Contributor

Perhaps you guys are tired of all the links to YouTubes I post, but this one is almost Unbelievable!

Mike Lindell shaves off his moustache (for just $2 you can watch!) to go to the DNC in disguise. Once there, he debates a 12 year-old kid ... and LOSES the debate!

That’s not weird at all.

Swammerdami

Squadron Leader

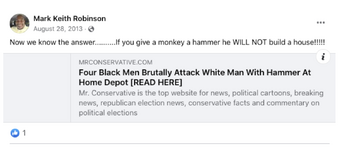

It's easy to find White Republicans saying stupid or bigoted things. But shouldn't we give equal time to Blacks and Democrats? Here are some comments by the Black Lieut. Governor of North Carolina, excerpted from a reputable website:

Reread that quote until you're as shocked as I! This Black Democrat seems as despicable as a White Republican like MTG.

I hope the Trumplickers at this Board will be happy I did their homework for them. Now they can say "same-same."

Uuuur... Wait a moment. Now I see that, while Black, Mark Keith Robinson is a Republican. And not just any Republican but a hard-core card-carrying MAGAturd.

. . . [Mark Keith] Robinson’s conspiratorial, racist, homophobic, antisemitic, and frankly batshit statements aren’t merely extreme: They are uniquely shocking, offensive, vulgar, and prejudiced ... and should be beyond the pale of political discourse.

. . .

Robinson hasn’t just made one or two cringey remarks. Prior to winning public office, he built his name on being an internet troll, especially on Facebook. He has spread lunatic conspiracy theories about Jews, like claiming that Jewish people created Black Panther “to pull the shekels out of your Schvartze [the Yiddish N-word] pockets” and that the Holocaust is being exaggerated for political purposes. “There is a REASON the liberal media fills the airwaves with programs about the NAZI and the ‘6 million Jews’ they murdered,” Robinson wrote in 2018, scare quotes included. He has said the “New World Order” is Satanic, along with the Olympics and Beyonce, while spouting the most vile, despicable things about gay people this side of the Westboro Baptist Church.

Reread that quote until you're as shocked as I! This Black Democrat seems as despicable as a White Republican like MTG.

I hope the Trumplickers at this Board will be happy I did their homework for them. Now they can say "same-same."

Uuuur... Wait a moment. Now I see that, while Black, Mark Keith Robinson is a Republican. And not just any Republican but a hard-core card-carrying MAGAturd.

Donald Trump enthusiastically supports Robinson, even calling him “better than Martin Luther King.” (Robinson is the first Black lieutenant governor in the state’s history.) ... And he has views about Black people that are, well, incredibly racist. Here’s Robinson calling out Black activists and defending the concept of “white pride”:

And here’s Robinson using the term “monkey” to refer to four Black men:

This is who Trump calls “better than Martin Luther King.”

Robinson’s comments on queer people also cross every line of decency. Indeed, he seems pathologically obsessed with us. To choose one of hundreds of examples, Robinson has this to say to those who say they were “born this way” and that sexual orientation is a trait:

- Joined

- Oct 22, 2002

- Messages

- 42,183

- Location

- Frozen in Michigan

- Gender

- Old Fart

- Basic Beliefs

- Don't be a dick.

- Joined

- Oct 22, 2002

- Messages

- 42,183

- Location

- Frozen in Michigan

- Gender

- Old Fart

- Basic Beliefs

- Don't be a dick.

- Joined

- Oct 22, 2002

- Messages

- 42,183

- Location

- Frozen in Michigan

- Gender

- Old Fart

- Basic Beliefs

- Don't be a dick.

Someone, please. Get this woman some help. Seriously.

- Joined

- Oct 22, 2002

- Messages

- 42,183

- Location

- Frozen in Michigan

- Gender

- Old Fart

- Basic Beliefs

- Don't be a dick.

Jesus, they're not even trying to hide it anymore.

- Joined

- Oct 22, 2002

- Messages

- 42,183

- Location

- Frozen in Michigan

- Gender

- Old Fart

- Basic Beliefs

- Don't be a dick.

Congress, next time please pass disaster measures that reject all funding to any state where nobody voted for the measure.

lpetrich

Contributor

On Xwitter, every now and then, I find some right-winger who claims that rural people are the real producers because they produce all the food that we eat.

I like to respond that without what city people make, rural people would be stuck in the Stone Age.

More specifically, the Neolithic, the technology of the first farmers.

Why? NO METALS.

No plastics, either.

Wood? Leather? One would be stuck with what one can easily cut with stone knives. That means no precision cutting, like what is necessary to make wooden wheels. So no wheels, either.

The wheel was invented in SE Europe not long after the widespread use of bronze in tools in that part of the world, andI suspect that that is no coincidence.

But Neolithic Middle Easterners and SE Europeans did have domestic animals -- bovines, sheep, goats, pigs, dogs -- and the larger ones could be used as work animals, carrying loads and pulling plows. List of domesticated animals Horses and donkeys were latecomers, but I'll be generous and accept them.

List of domesticated animals Horses and donkeys were latecomers, but I'll be generous and accept them.

I like to respond that without what city people make, rural people would be stuck in the Stone Age.

More specifically, the Neolithic, the technology of the first farmers.

Why? NO METALS.

No plastics, either.

Wood? Leather? One would be stuck with what one can easily cut with stone knives. That means no precision cutting, like what is necessary to make wooden wheels. So no wheels, either.

The wheel was invented in SE Europe not long after the widespread use of bronze in tools in that part of the world, andI suspect that that is no coincidence.

But Neolithic Middle Easterners and SE Europeans did have domestic animals -- bovines, sheep, goats, pigs, dogs -- and the larger ones could be used as work animals, carrying loads and pulling plows.

lpetrich

Contributor

Let's say that you want to make some hamburger.

You'll need bread for the bun, meat in the middle, and vegetables on the meat.

To make the bun, you'll need grain, and here's how you'll get it.

You have to plow a field, with the plow pulled by a bovine or a horse or a donkey. You then sow seeds in the plowed land. The grain then grows, and you'll have to reap it, cut off the upper parts of the plants. Once you do that, you'll have to thresh it, to beat it so that the grain comes loose from its parent plants. Then you have to winnow it, to separate the grain from its parent plants, the wheat from the chaff. All because you don't have a combine harvester, a machine that reaps, threshes, and winnows.

Once you have your grain, you now have to grind that grain by hand to make flour, and you then mix the flour with water to make bread dough. You may now add some starter dough, some leaven, to make the bread rise. Once it is ready to go, you must then bake it. You must get the fuel by chopping down some trees with a stone ax, though you can bring the wood home on the backs of your larger animals. You might also collect farm-animal dung and dry it out.

You grow vegetables the way that you grow grain, but harvesting is easier. Pick your vegetables by hand. There is the problem of preserving it, but you can make vinegar by doing extra fermentation or else get saltwater from the sea, and you then soak the vegetables in this acid or salty water.

Meat patty? You will have to chop up the meat by hand, and do a lot of chopping. Slaughtering an animal will give you plenty of meat, so you must preserve it, and a simple way to do so is to dry it. You can also use saltwater, making salted meat.

You'll need bread for the bun, meat in the middle, and vegetables on the meat.

To make the bun, you'll need grain, and here's how you'll get it.

You have to plow a field, with the plow pulled by a bovine or a horse or a donkey. You then sow seeds in the plowed land. The grain then grows, and you'll have to reap it, cut off the upper parts of the plants. Once you do that, you'll have to thresh it, to beat it so that the grain comes loose from its parent plants. Then you have to winnow it, to separate the grain from its parent plants, the wheat from the chaff. All because you don't have a combine harvester, a machine that reaps, threshes, and winnows.

Once you have your grain, you now have to grind that grain by hand to make flour, and you then mix the flour with water to make bread dough. You may now add some starter dough, some leaven, to make the bread rise. Once it is ready to go, you must then bake it. You must get the fuel by chopping down some trees with a stone ax, though you can bring the wood home on the backs of your larger animals. You might also collect farm-animal dung and dry it out.

You grow vegetables the way that you grow grain, but harvesting is easier. Pick your vegetables by hand. There is the problem of preserving it, but you can make vinegar by doing extra fermentation or else get saltwater from the sea, and you then soak the vegetables in this acid or salty water.

Meat patty? You will have to chop up the meat by hand, and do a lot of chopping. Slaughtering an animal will give you plenty of meat, so you must preserve it, and a simple way to do so is to dry it. You can also use saltwater, making salted meat.

Exactly. In time their stuff will wear out and they can't replace it. That's why a collapse of civilization is unrecoverable.On Xwitter, every now and then, I find some right-winger who claims that rural people are the real producers because they produce all the food that we eat.

I like to respond that without what city people make, rural people would be stuck in the Stone Age.

More specifically, the Neolithic, the technology of the first farmers.

Why? NO METALS.

No plastics, either.

Wood? Leather? One would be stuck with what one can easily cut with stone knives. That means no precision cutting, like what is necessary to make wooden wheels. So no wheels, either.

The wheel was invented in SE Europe not long after the widespread use of bronze in tools in that part of the world, andI suspect that that is no coincidence.

But Neolithic Middle Easterners and SE Europeans did have domestic animals -- bovines, sheep, goats, pigs, dogs -- and the larger ones could be used as work animals, carrying loads and pulling plows.List of domesticated animals Horses and donkeys were latecomers, but I'll be generous and accept them.

But I disagree on the wheel. If you come into the situation with the knowledge I think you can make a wheel with stone tools--specifically, via a lathe. But note that lathes are a form of wheel, thus it would have been impossible to invent that approach.