Allow me to remind the factually challenged and the forgetful there was an inspector general's report on this:

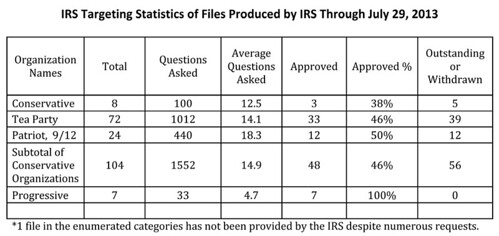

The IRS used inappropriate criteria that identified for review Tea Party and other organizations applying for tax-exempt status based upon their names or policy positions instead of indications of potential political campaign intervention. Ineffective management: 1) allowed inappropriate criteria to be developed and stay in place for more than 18 months, 2) resulted in substantial delays in processing certain applications, and 3) allowed unnecessary information requests to be issued. Although the processing of some applications with potential significant political campaign intervention was started soon after receipt, no work was completed on the majority of these applications for 13 months.... For the 296 total political campaign intervention applications [reviewed in the audit] as of December 17, 2012, 108 had been approved, 28 were withdrawn by the applicant, none had been denied, and 160 were open from 206 to 1,138 calendar days (some for more than three years and crossing two election cycles).... Many organizations received requests for additional information from the IRS that included unnecessary, burdensome questions (e.g., lists of past and future donors).