- Joined

- Oct 22, 2002

- Messages

- 47,297

- Location

- Frozen in Michigan

- Gender

- Old Fart

- Basic Beliefs

- Don't be a dick.

My technologies fund dropped five and a half percent in just this past week.

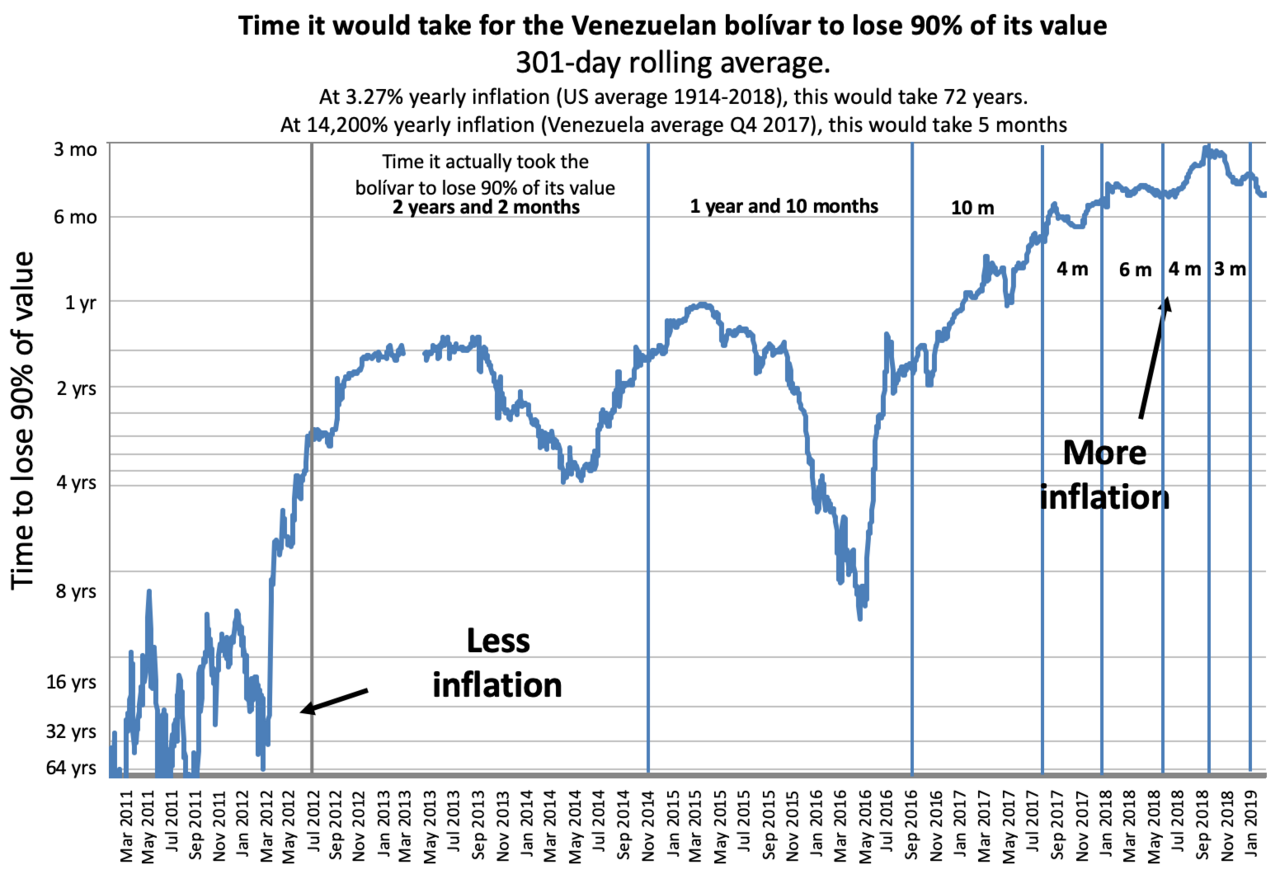

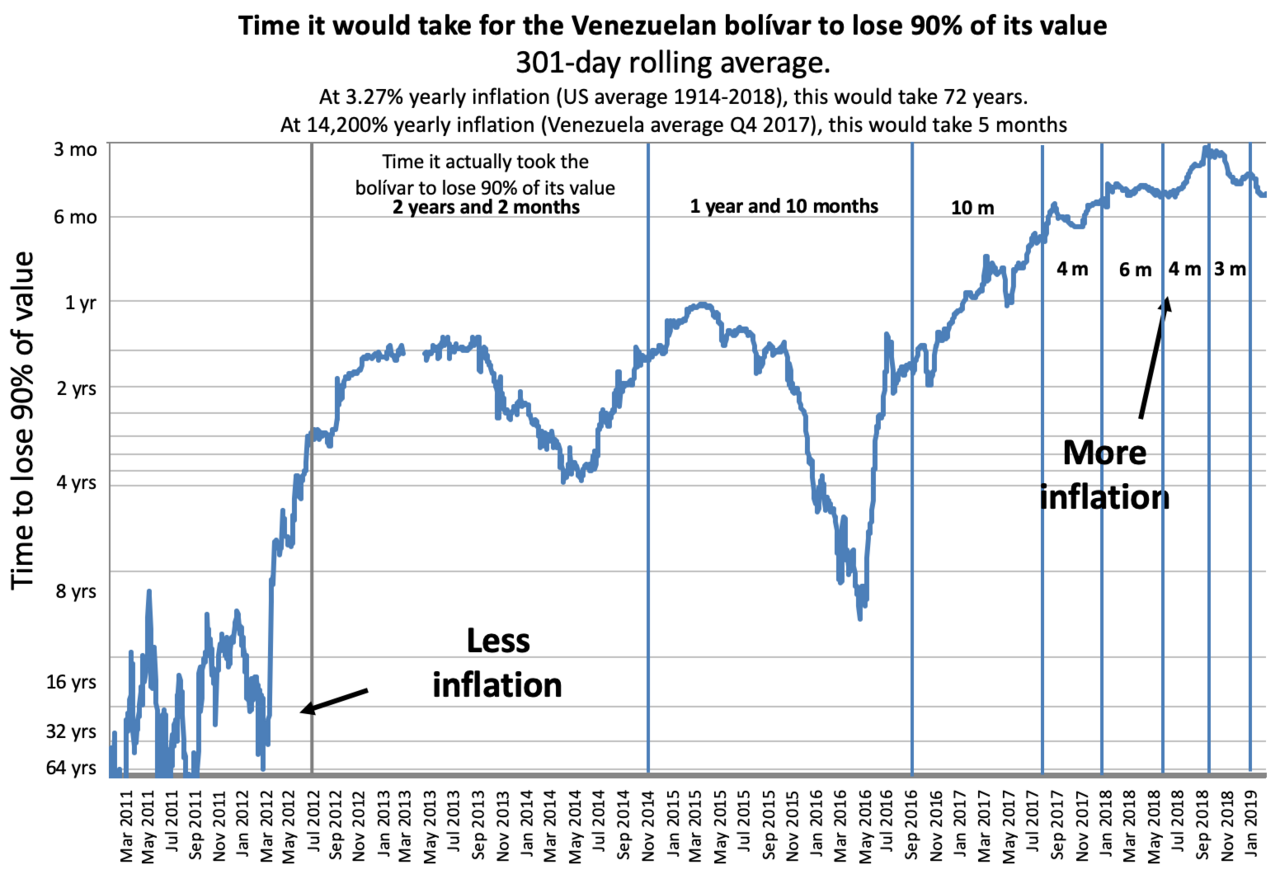

Looking now I see it is indeed hideous!. A large swathe is very roughly logarithmic, but neither top nor bottom is. And the y-axis labels seem inconsistently aligned.What in the world is the vertical on that thing? It kind of looks log-ish, but it isn't.Color me optimistic perhaps, but I'll guess that the U.S., even with "banana Republic-style" governance, will fare better than those examples in South America.

Meh. That happens in the best of times. My little bit of OKLO is down more than 10% this week. I feel like it’s likely for many stocks and mutuals to lose double digit percentages of value per month for a while, under Trump’s expert economic wisdom. I think there’s still a limit to the damage he can cause though.My technologies fund dropped five and a half percent in just this past week.

OK. Obviously RVonse's assertion was silly.Yes, to refute RVonse's flat assertion to the effect that returns on gold are always positive...The "1980" above was cherry-picked.

Yeah, the vertical is bogus, making the whole thing deceptive. Most of it is exponential but it falls apart at the bottom.What in the world is the vertical on that thing? It kind of looks log-ish, but it isn't.Color me optimistic perhaps, but I'll guess that the U.S., even with "banana Republic-style" governance, will fare better than those examples in South America.

Everything is explained here:I have no idea what this means. I admit I am a dummy when it comes to this stuff.I will NOT make any prediction beyond general unease and disbelief. As U.S. governance loses credibility, regimes like Russia and especially China will gain in relative financial strength and geopolitical dominance. The U.S.'s weakening fiscal position -- which will deteriorate further under Trump -- will be accepted by the world's bankers . . . until it isn't.

Here is a snapshot of some asset prices today:

- Today (Wednesday) the S&P 500 set an all-time record. Its P/E is a whopping 27.5; yield is only 1.17%.

- The Nasdaq-100 set its all-time record yesterday. Its P/E is a whopping 35.2; yield is only 0.54%.

- The German DAX stock index also just set an all-time high, with P/E 19.83 and yield 2.04%.

- A year ago the Japanese stock market finally bested its 1989 high and is still near that record territory.

- Gold is at an all-time high, almost $3000/ounce, 15% higher than it was in mid-November and about 2½ times what it was at the time of Trump-45's election.

- Bitcoin soared to an all-time high after the Trump-47 election but has fallen somewhat during February.

- During 2022-2023 interest rates soared above their high during the 2007 bubble, and the yield curve "inverted." (Inverted yield curves usually presage recessions.) Yield on the 10-year Treasury is now 4.6% and yields remain almost inverted.

So, Are they going to impeach the felon? Was that more than just a rant? Apparently not.Everything is explained here:

Everything is explained here:I have no idea what this means. I admit I am a dummy when it comes to this stuff.I will NOT make any prediction beyond general unease and disbelief. As U.S. governance loses credibility, regimes like Russia and especially China will gain in relative financial strength and geopolitical dominance. The U.S.'s weakening fiscal position -- which will deteriorate further under Trump -- will be accepted by the world's bankers . . . until it isn't.

Here is a snapshot of some asset prices today:

- Today (Wednesday) the S&P 500 set an all-time record. Its P/E is a whopping 27.5; yield is only 1.17%.

- The Nasdaq-100 set its all-time record yesterday. Its P/E is a whopping 35.2; yield is only 0.54%.

- The German DAX stock index also just set an all-time high, with P/E 19.83 and yield 2.04%.

- A year ago the Japanese stock market finally bested its 1989 high and is still near that record territory.

- Gold is at an all-time high, almost $3000/ounce, 15% higher than it was in mid-November and about 2½ times what it was at the time of Trump-45's election.

- Bitcoin soared to an all-time high after the Trump-47 election but has fallen somewhat during February.

- During 2022-2023 interest rates soared above their high during the 2007 bubble, and the yield curve "inverted." (Inverted yield curves usually presage recessions.) Yield on the 10-year Treasury is now 4.6% and yields remain almost inverted.

I'd venture to guess other Tesla investors, especially those upper management employees who hold Tesla stock aren't too crazy about Musk right now. I wonder if they'd like to do the "no confidence" thing and boot him as CEO. I think he owns like 14% of the shares. He's got to be killing Tesla's demographic. I don't know. I suppose Tesla owners are mostly in CA. I see a Tesla about as often as I see a car with hubcaps.Well, another 900 point drop in the Dow today. Nothing to worry about! Just a minor correction.

In other news (completely unrelated), Tesla shares fell another 15% today. It's now less than 50% of it December 2024 high. Protestors are in part to blame too. Protests at dealerships and vandalism against Teslas, aka Swasticars, are driving people away - people just are not going to take the risk. A 50% drop in sales in Europe. UBS says it has not reached bottom yet. Hardly surprising considering its PE ratio is still over 100. GM's is 7.5.

Not that Leon Kums is going to be significantly effected. He's having too much fun destroying our federal government and social security to notice.

Their upcoming car is an SUVThe cyber trucks are a joke anyway. You can't use them as a truck. My Honda minivan could hold as much brick or mulch. They can't tow because electric drops too fast with a filled trailer.

They should have made an SUV instead.

And their brand spokesman shouldn't be more toxic than Jared from Subway.

They just recently voted in favor of restoring his $40 billion bonus that a judge turned down, so I don't see them turning on him any time soon.I'd venture to guess other Tesla investors, especially those upper management employees who hold Tesla stock aren't too crazy about Musk right now. I wonder if they'd like to do the "no confidence" thing and boot him as CEO. I think he owns like 14% of the shares. He's got to be killing Tesla's demographic. I don't know. I suppose Tesla owners are mostly in CA. I see a Tesla about as often as I see a car with hubcaps.Well, another 900 point drop in the Dow today. Nothing to worry about! Just a minor correction.

In other news (completely unrelated), Tesla shares fell another 15% today. It's now less than 50% of it December 2024 high. Protestors are in part to blame too. Protests at dealerships and vandalism against Teslas, aka Swasticars, are driving people away - people just are not going to take the risk. A 50% drop in sales in Europe. UBS says it has not reached bottom yet. Hardly surprising considering its PE ratio is still over 100. GM's is 7.5.

Not that Leon Kums is going to be significantly effected. He's having too much fun destroying our federal government and social security to notice.

They just recently voted in favor of restoring his $40 billion bonus that a judge turned down, so I don't see them turning on him any time soon.I'd venture to guess other Tesla investors, especially those upper management employees who hold Tesla stock aren't too crazy about Musk right now. I wonder if they'd like to do the "no confidence" thing and boot him as CEO. I think he owns like 14% of the shares. He's got to be killing Tesla's demographic. I don't know. I suppose Tesla owners are mostly in CA. I see a Tesla about as often as I see a car with hubcaps.In other news (completely unrelated), Tesla shares fell another 15% today. It's now less than 50% of it December 2024 high....

What did you expect? Perhaps if there were some incentive for buying one. Musk shits all over his own car company. Trump does everything he can to dissuade people from buying an EV and it’s the leftist loonies fault. A couple of senators even want to tack on a $1000 fee for the loss of gas taxes.CNBC article said:Trump said “radical left lunatics” are “illegally and collusively” boycotting Tesla

There’s a bumper sticker for that.CNBC Talkinghead said:“When people’s cars are in jeopardy of being keyed or set on fire out there, even people who support Musk or are indifferent Musk might think twice about buying a Tesla,”

I couldn't read it - it was burned.There’s a bumper sticker for that.

What do you mean "no gain"?? Trump said we'll be so rich we won't even know how to spend all our money!! I seriously can't wait for that moment as I'm sick and tired, as most Americans must be, of worrying about how to spend our money. Right, my friends???

To make matters worse, North American metals is ridiculously intertwined between the US, Canada, and Mexico. We rely on each other every step of the way. And Trump is fucking it up... for no gain to the US.

No worries, Trump will spend it for you.I'm sick and tired, as most Americans must be, of worrying about how to spend our money.

Will he be affected when the BOD votes him out? Lawsuits against him for destroying people's investments?Well, another 900 point drop in the Dow today. Nothing to worry about! Just a minor correction.

In other news (completely unrelated), Tesla shares fell another 15% today. It's now less than 50% of it December 2024 high. Protestors are in part to blame too. Protests at dealerships and vandalism against Teslas, aka Swasticars, are driving people away - people just are not going to take the risk. A 50% drop in sales in Europe. UBS says it has not reached bottom yet. Hardly surprising considering its PE ratio is still over 100. GM's is 7.5.

Not that Leon Kums is going to be significantly effected. He's having too much fun destroying our federal government and social security to notice.