And yet they are still paying lower effective rates, and they still would be if these rates came to be today, so this is a pointless canard that doesn't address anything.

Everyone already knows that effective tax rates are lower than the nominal rate. There is no need to remind people.

People keep pointing out those old very high rates didn't cause catastrophe as evidence we can go to such rates again. I'm pointing out that it isn't such evidence as the rates never really existed in the first place.

Oddly enough, I have to agree with Loren, which is rare for me.

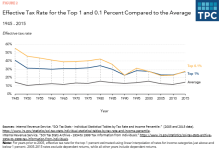

. People often claim that the highest tax rates in the 50s were over 90%, but the reality is that the highest tax rates were around 50% because of all the tax breaks and deductions. I think we need to be more honest and not talk about what the highest rate was listed at, but what the highest rate was in reality.

Sure, it's lower now and I totally agree that it needs to be higher, but nobody in the US has ever paid a 90% tax rate, so why can't we all be honest about what the wealthiest really paid instead of making the false claims that they paid 90% in taxes. 90% is not realistic. If you have a lick of sense, you would realize or admit that. If the rate were that high in reality, most of the mega rich would apply for citizenship in one of the European countries that have much lower tax rates. And, you know damn well, that mega wealthy people are almost always welcomed in other countries. We have a few billionaires that give most of their money away to charity, but most don't do that. So, most would probably do whatever they have to do to hold on to their fortunes.

So, what is a reasonable tax rate for the mega wealthy? What is a reasonable tax rate for people who only make 20 -50,000 per year? If we are able to accomplish most of what people like AOC want, how much in taxes would you be willing to pay? From what I've read in the past, most people don't want to have their taxes increased in exchange for most of these social programs. I think that's unreasonable too. We should all be willing to pay more taxes in exchange for programs that would drastically decrease poverty, give better access to health care, better public education, and help for those who need it during childhood and old age, etc. We can't simply expect the wealthiest to be able to support the rest of us. We all need to pitch in and pay more. Most countries that have the type of social programs desired by people like AOC are very willing to pay more taxes in return for the security that these programs bring. I'm not sure that most Americans feel that way.

The problem that I've always had with Bernie, is that he never gives us any realistic details as to how to initiate and support the type of programs that people like him support. So, it ends up sounding like pie in the sky. If one wants change, one needs a detailed plan as to how to install these changes, as well as a plan as how to convince the majority of Congress to vote for these measures. We are supposedly a center right country. I'd like to believe we're more of a center left country, but either way, it's not going to be easy to make large changes without the support of the majority.

I don't oppose most of these changes. I just don't see a way to accomplish them rapidly, if at all.

” - linking to an Instagram slideshow on it

” - linking to an Instagram slideshow on it just shy of 10,000 of you started following me recently! Hello and thank you for wanting to learn + grow with me

just shy of 10,000 of you started following me recently! Hello and thank you for wanting to learn + grow with me  …”

…” ”

”