Some people almost think we're facing a purely

binary choice: EITHER it will be business as usual, OR it will be an Apocalypse, with banknotes and stock certificates being burned in fireplaces for kindling.

In the real world, a "currency collapse" is likely to fall short of a worst-case Apocalypse. I won't try to predict when or how the Big Dollar Collapse will play out but typically debt becomes unsustainable, high inflation and high interest rates arise and banks become highly illiquid or even insolvent. One solution is "haircuts" to bonds (Trump has proposed this) or to bank accounts.

- During the

2012–2013 Cypriot financial crisis "Cyprus agree[d] to close the country's second-largest bank, the Cyprus Popular Bank (also known as Laiki Bank), imposing a one-time bank deposit levy on all uninsured deposits there, and seizing possibly around 48% of uninsured deposits in the Bank of Cyprus (the island's largest commercial bank)."

2012–2013 Cypriot financial crisis "Cyprus agree[d] to close the country's second-largest bank, the Cyprus Popular Bank (also known as Laiki Bank), imposing a one-time bank deposit levy on all uninsured deposits there, and seizing possibly around 48% of uninsured deposits in the Bank of Cyprus (the island's largest commercial bank)."

(This is why it is good to open multiple bank accounts if your banked savings exceed the government-insured limit. Recently I read that Thailand's banks MIGHT be insolvent)

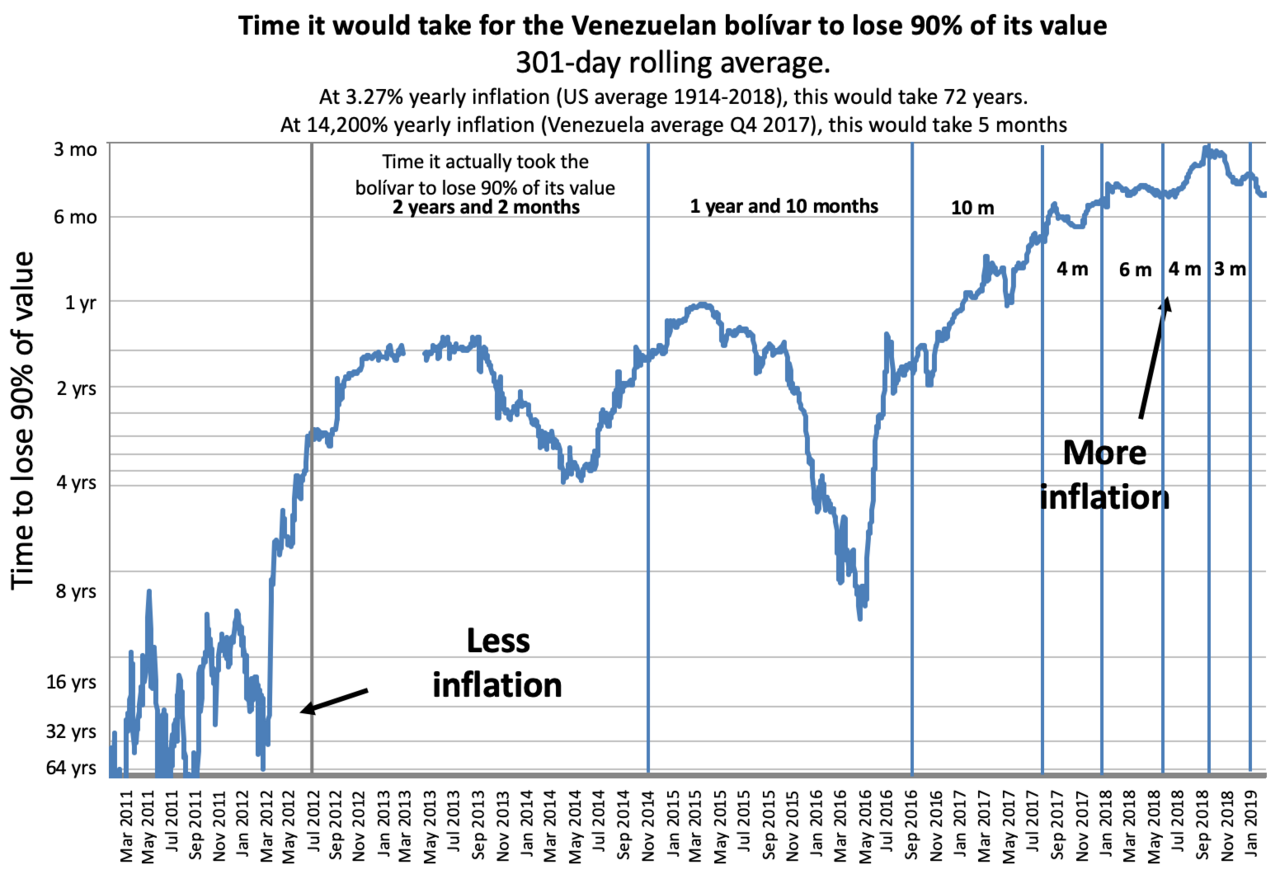

Cyprus used the Euro so devaluing that currency was not an option. Countries with sovereign currencies may respond to crisis with devaluation. Argentina has been relatively prosperous -- even now its GDP(PPP) per capita is still ahead of Mexico, Thailand and China and nearly as high as Chile -- but has had MANY bouts of hyperinflation over its history. But the best graph that popped up via Google was for Venezuela's recent hyperinflation (see below).

In a scenario like Argentina's or Venezuela's hyperinflation, there will be chaos and great financial grief. Perhaps good Googlers can turn up personal accounts: How were families able to buy food, canned or not? What was used for money? I suppose U.S. dollars make much better money that precious metals in such circumstances so it may be hard to find a precedent for a

Dollar collapse.

Color me optimistic perhaps, but I'll guess that the U.S., even with "banana Republic-style" governance, will fare better than those examples in South America.

Same chart for gold. People who bought at the peak in 1980 are still underwater...

Make sure to compare apples with apples. Obviously you are using inflation-adjusted dollars for your gold price, typically NOT used when quoting stock prices. Ignoring dividends, gold purchased at any time during 1997-2005 would have more value today than the same money invested in SP500. (The same applies to gold purchased 1965-1971.)

Let's be clear. I am NOT a gold -bug and am hardly recommending to buy gold as a hedge given today's high price. I am just a Seeker of Truth! I get tired of people twisting the facts to make gold seem like an unusually bad hedge investment. Example: The "1980" above was cherry-picked. I demonstrated that one can also pick cherries from a different tree!

If you must buy gold, are ETFs better than physical metal? Perhaps, unless you suspect the financial crisis will be so severe that there is general collapse.

It costs a good deal to buy physical metals... the cash is paying fees, not buying metals. And if you have lots of gold on you after a currency collapse, best not let anyone know.

What's the sell-buy spread in the U.S. on gold coins? bullion? (The spread on Thai bullion here is quite small.)