Harry Bosch

Contributor

Warren and Bernie want to dramatically increase the taxes on wealth. Bernie wants to tax wealth at 50%. I guess that means tax at 50% of it's value. Well, market value is a value at a specific time. Secondly, value does not equal cash. The only way to get cash out of stocks is to sell it. Guess what happens when Bezos sells 50% of his Amazon stock? The stock will fall like a rock. Most retirement portfolios rely on stocks. Dramatically increasing wealth taxes will wipe out many people's retirement.

I see what you mean. The wealth tax idea was the main reason I hesitated about Warren. But that was before Bernie's heart attack, and now he's trying to outdo Warren on the wealth tax scheme. It's even a worse idea in light of that point you made. I've always said they should tax the rich more but by simply increasing the marginal tax rates. While taking away some of the reward it doesn't act as a disincentive the way a wealth tax would. Capitalism provides more than enough incentive for the super-wealthy to stay invested. All I want to do is flatten out the distribution curve on economic growth.

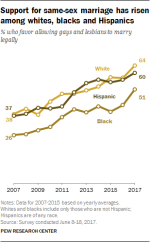

View attachment 24258

Not do some kind of claw-back. As the article that chart came from said:

The idea behind a tax like this is that it would significantly reduce the accumulation of extreme wealth. For one, the tax itself would incentivize wealthy people to, well, be less wealthy in the eyes of the government. As Yglesias explained:

[T]he mere existence of the wealth tax would, on the margin, encourage wealthy individuals to dissipate their fortunes on charitable giving and lavish consumption. If you try to horde wealth the government is going to tax it, so you might as well spend it.

That is both a feature and a bug. But as some experts have pointed out, it might also encourage rich people to hide their wealth. As Saez and Zucman have written in the past, these kinds of tax proposals are “fragile.”

“They can be undermined by tax limits, base erosion, and weak enforcement,” the economists wrote in an early September 2019 paper. That’s why many countries have abandoned them. As Yglesias pointed out, of the 12 OECD-member nations that had wealth taxes in 1990, only four — France, Norway, Spain, and Switzerland — continue to implement them. But Zucman and Saez argue “that tolerating tax competition and tax evasion is a policy choice.”

Sanders does address enforcement in his plan.

He is calling for a “national wealth registry and significant additional third party reporting requirements,” as well as increasing Internal Revenue Service funding to enforce the wealth tax. The plan calls for a mandated IRS audit of 30 percent of wealth tax returns for those in the 1 percent bracket and a 100 percent audit for all the billionaires. It also establishes a 40 percent exit tax on the net value of all assets under $1 billion and 60 percent over $1 billion for anyone that wants to take their wealth to another country.

So it seems to actually penalize any efforts by the super-successful that result in additional profits and encourages them to spend it frivolously. That's plain counter-productive. And the additional audits will increase pressure on politicians to invent ways to hide that wealth. Just keep it simple with higher marginal tax rates is what I say.

Agreed. Or another way to say it, tax distributions or when wealth is converted to cash.

Mayor Pete

Mayor Pete