- Joined

- Oct 22, 2002

- Messages

- 46,999

- Location

- Frozen in Michigan

- Gender

- Old Fart

- Basic Beliefs

- Don't be a dick.

Holy crap! Gas prices here have gone up 40 cents/gallon over the weekend.

Down to $1.73 as of last night. Maybe I should have topped up my tank.You must be kidding! It is an indisputable fact, my dear ZiprHead, that every time fuel prices go up it is Biden's fault, and every time they go down it is Trump's achievement. Yes, even here in Australia.Did Biden release gas from your reserves too.It's come down considerably here, from $2+ a litre to around $1.60, just in the last few days

The price of 91 octane petrol at my local fuel stop has dropped from $2.06/l ten days ago to $1.89 last Monday. Thank you, Donald. You're a genius.

$5.46 today.$5.30 at Costco. Down a bit from a few weeks ago.

How is this Biden's or Newsom's fault?$5.46 today.$5.30 at Costco. Down a bit from a few weeks ago.

Let's Go Brandon!! (and Newsom)

Dur.How is this Biden's or Newsom's fault?$5.46 today.$5.30 at Costco. Down a bit from a few weeks ago.

Let's Go Brandon!! (and Newsom)

$5.46 today.$5.30 at Costco. Down a bit from a few weeks ago.

Let's Go Brandon!! (and Newsom)

$5.52 today, up another $.03.$5.46 today.$5.30 at Costco. Down a bit from a few weeks ago.

Let's Go Brandon!! (and Newsom)

$5.49 today, up $.03.

Let's Go Brandon!!

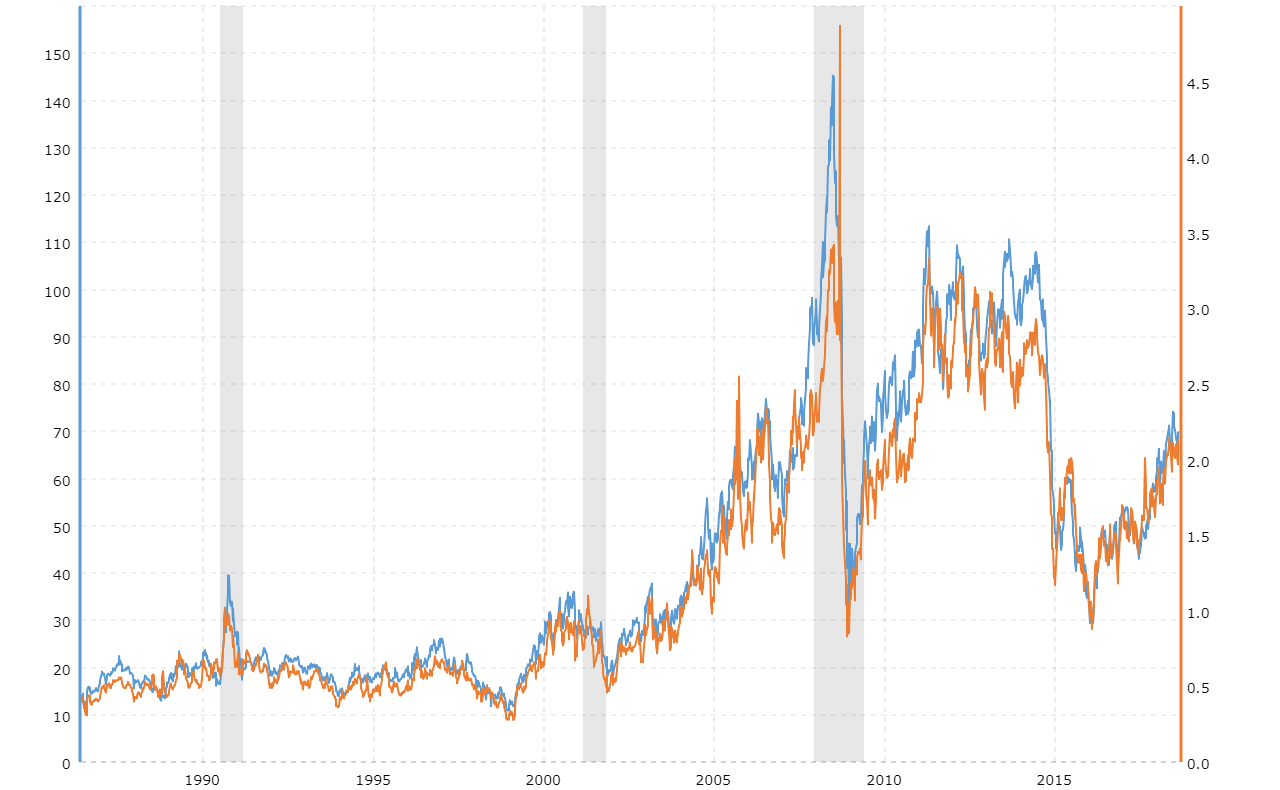

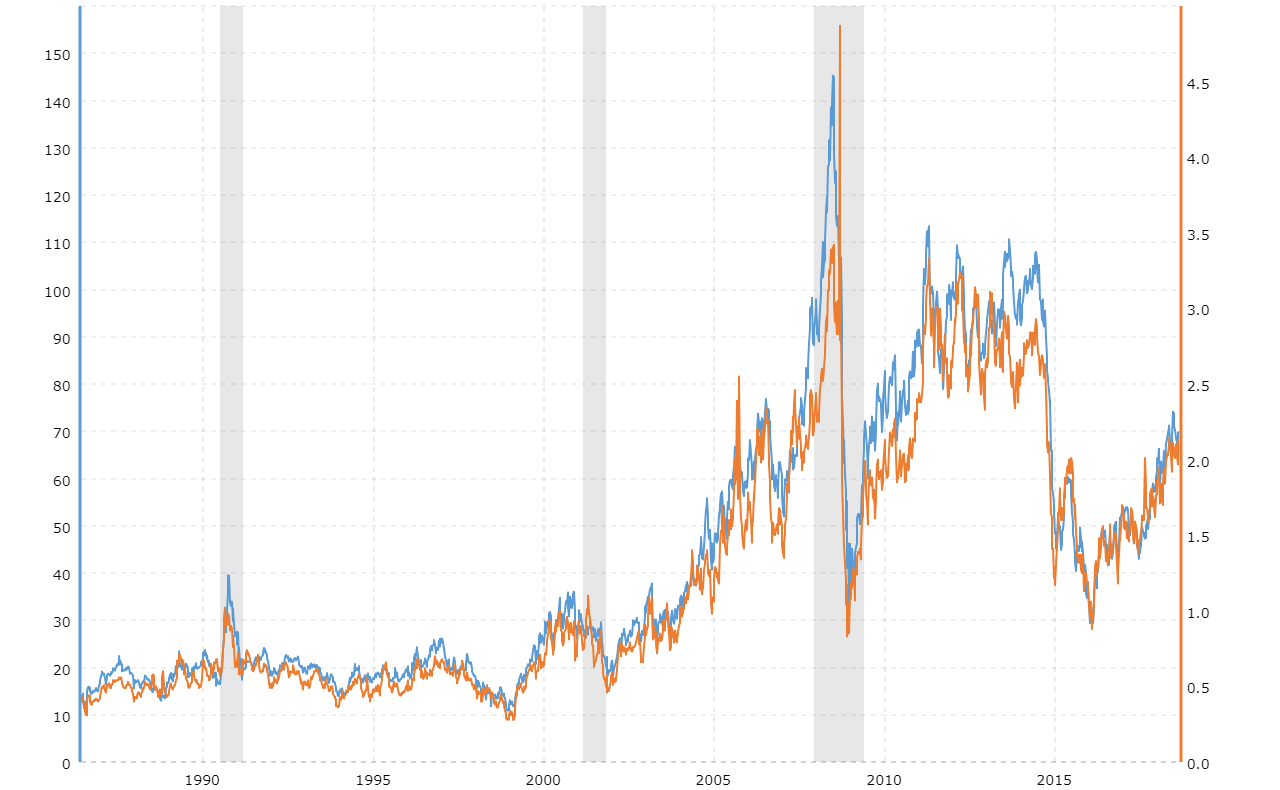

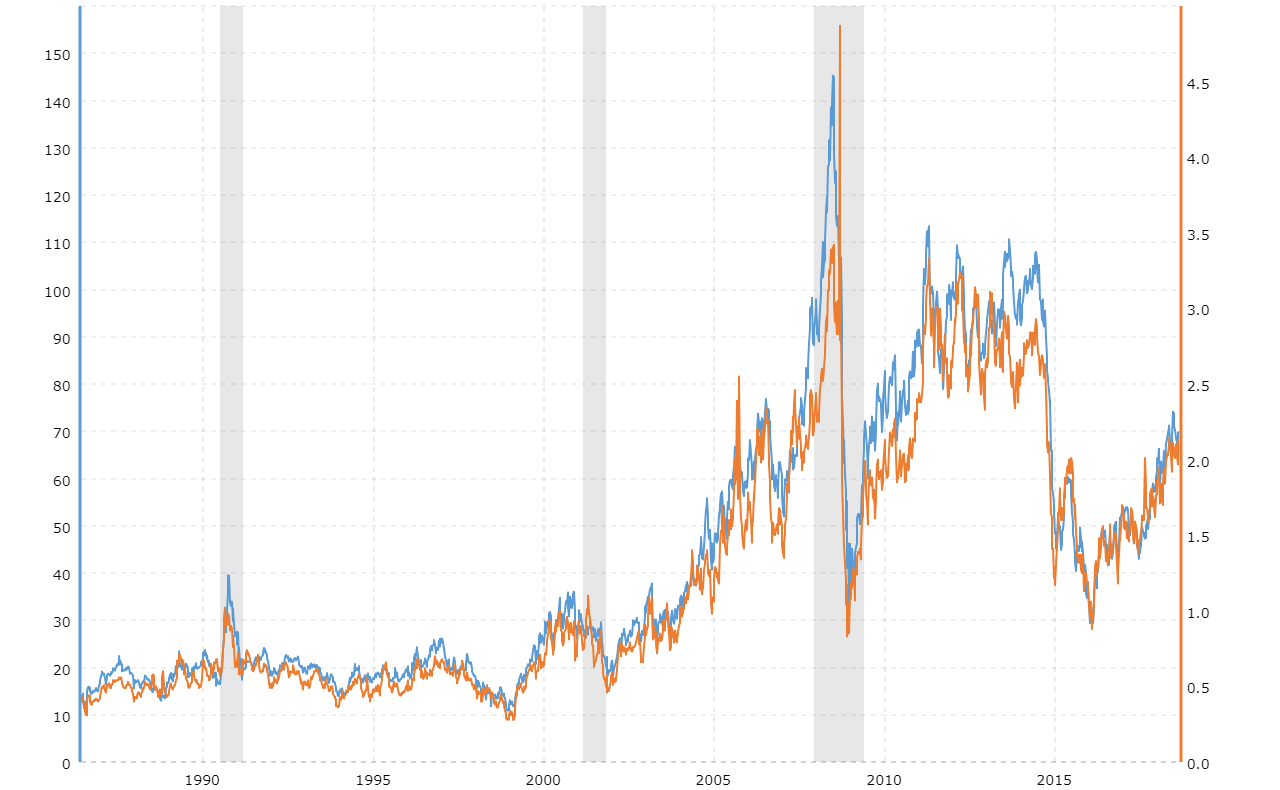

I don't think you can make such a claim for series plotted against different axes. The choice of axes determines whether any 'reversal' is present, not the data.View attachment 38545

Notice that the trend oil prices vs fuel prices have reversed. (oil is blue, fuel is red)

Crude Oil vs Gasoline Prices

This interactive chart compares the monthly price performance of West Texas Intermediate (WTI) Crude Oil vs national average gasoline prices back to 1986.www.macrotrends.net

Went to Costco for gas this evening, $5.57. An increase of $.05 since Tuesday, two days ago!! <img Brandon I Did That /img$5.52 today, up another $.03.$5.46 today.$5.30 at Costco. Down a bit from a few weeks ago.

Let's Go Brandon!! (and Newsom)

$5.49 today, up $.03.

Let's Go Brandon!!

Let's Go Brandon!! (and Newsom)

The differential is actually worse than the graph makes it appear. Between the 3rd of January and the 9th of MayI don't think you can make such a claim for series plotted against different axes. The choice of axes determines whether any 'reversal' is present, not the data.View attachment 38545

Notice that the trend oil prices vs fuel prices have reversed. (oil is blue, fuel is red)

Crude Oil vs Gasoline Prices

This interactive chart compares the monthly price performance of West Texas Intermediate (WTI) Crude Oil vs national average gasoline prices back to 1986.www.macrotrends.net

When your conclusion is based on an observation that is independent of the data, and is instead an artefact of your choice of presentation, you have a problem.

But assuming that there is something to discuss here, why would it be important that finished product retail prices have increased slightly faster than raw material prices?

All your graph appears to show is that the rate of change of these two numbers is usually similar, but rarely the same. Which is rather what one would have expected, no?

This looks like retailers in a product with fairly low profit margins widening those margins slightly, in response to increased volatility of wholesale prices. Which is just sensible business practice.

$5.52 today, up another $.03.$5.46 today.$5.30 at Costco. Down a bit from a few weeks ago.

Let's Go Brandon!! (and Newsom)

$5.49 today, up $.03.

Let's Go Brandon!!

Let's Go Brandon!! (and Newsom)

Be careful. Some shonky operators sell at discount prices by thinning their petrol out with kerosene. Your mileage will drop and the mix harms your car's motor.Prices in Melbourne, Australia crashed through to about $2.15/L on the weekend.

Yet today I am in Ballarat, about 1.5 hours NW of Melb and petrol was about $1.75/L. Very strange. I must fill up before I leave.

Don't you know presidents have magical powers to control the economy?Wow! Somebody thinks that this Brandon guy is powerful enough to control a global commodity. Somebody needs a lesson in supply and demand and the numerous things that impact a global commodity.

Btw, Georgia is one of 4 states, or so I've heard, where gas is under 4 bucks a gallon. Thanks Brandon! /s